Even as the rupee touched a new low for the fifth-straight day on Wednesday, September 28, former Reserve Bank of India (RBI) Governor Duvvuri Subbarao said it is not yet time for special schemes to attract NRI deposits.

He said macros are not as bad as 2013 but twin deficits still make India vulnerable.

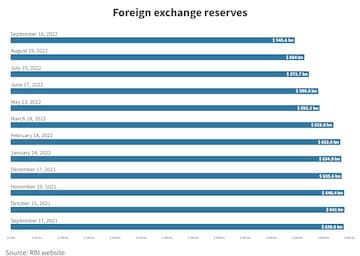

"The rupee has depreciated 10 percent, forex reserves are down by $100 billion," he said, adding that there is pressure because the current account deficit (CAD) has widened due to the FPI outflows and Fed tightening.

The US Fed recently hiked interest rates by 75 bps for the third consecutive time to fight inflation.

Foreign Portfolio Investors (FPIs) have been net sellers of Indian shares for a while now. On Tuesday, FPIs remained net sellers for the fifth-straight day — the longest chain of daily outflows for Dalal Street since July 23 and the heaviest since July 4. They pulled out a net Rs 13,795.5 crore from Indian equities for five trading days till September 27, according to provisional exchange data. Subbarao said that the rupee is not as vulnerable as it was during the 2013 taper tantrum. "In 2013, the rupee was under pressure because it was overvalued and bled suddenly. Now, the rupee is tracking fundamentals," he said.

He also spoke about how CAD is high this time, but it could probably be a one-off due to crude. "CAD is less of a worry than it was six months ago," he said. He also believes the trade deficit will drop from $30 billion/month to $22 billion/month.

'No possibility we will be in a comfort zone any time soon'

India's CAD is expected around 3 to 3.5 percent of the GDP, Subbarao said.

"The RBI used to say 3 percent is the upper limit, now it says 2.5 percent is the safe level. In the six years up to the COVID-19 pandemic, CAD was running at 1 to 1.5 percent of the GDP," the former RBI Governor said, adding that the Centre and state deficits are still relatively high. He believes the second year of high CAD is possible.

Talking about recession, Subbarao said that the "r-word looks more probable than it did three months ago." If there is a recession, exports will be hit. "That will be a vulnerability on the external front. If there is a recession, oil prices will go down," he said.

'FX reserves was a strong buffer, but big caveats to that statement'

Forex reserves were a substantial reserve for India last year, but they are much less now, Subbarao said.

Some experts say one metric for measuring forex reserves is as a percentage of GDP, which was 21 percent last year. Now, it is down to 17 percent, he said. "Forex reserves to GDP were at 15 percent during the taper tantrum. They are less of a buffer now than last year," he said.

The rates at which reserves are coming down, or the burn rate also shapes the market perception.

'Every central bank worries about the impact of its rate stance on currency, especially EM central banks'

"No one admits to using rates to defend the exchange rate, but they all look at it," the former RBI Chief said, adding that when EMs calibrate monetary policy, they look at what impact it has on the exchange rate.

He said the impact of a rate hike on exchange and inflation could not be bifurcated. Even the RBI has to tighten its rates for inflation management. "Decision point of whether RBI must hike solely for exchange rate has not come," he said.

'RBI is anyways cooling demand with its rate hikes; they restrain demand to restrain inflation'

Subbarao believes the RBI should use interest rates to cool the demand and inflation and use depreciation to restrain some of the imports.

"The RBI should allow depreciation to restrain some of the imports and support exports. Using rates to restrain inflation, depreciation to restrain imports would be a good mix," he said.

'Two months ago, RBI took steps to make fx flows easier'

Subbarao said that two months ago, the RBI had taken steps to make the foreign flows easier. "The swap scheme in 2013 by former RBI Chief Raghuram Rajan worked well to bring inflows. Using a special scheme (for $ deposits) is like a 'Brahmastra', it may spook the market," he said.

Subbarao said that RBI managers and foreign exchange dealers are smarter than the market gives them credit. "The market tries to game the RBI, and the RBI also tries to surprise the market," he said.

He spoke about the narrative created by the market that "RBI is protecting a level like 80". "RBI managers know such narratives are created and try to be unpredictable," he added.

First Published: Sept 28, 2022 5:42 PM IST