In a concerning development for India's financial sector, worries are intensifying as unsecured loan growth continues to surge, and non-performing assets (NPAs) register an alarming increase. This pressing issue has raised red flags within the nation's economic landscape, prompting a thorough examination of the potential risks associated with this rapid expansion.

The

Reserve Bank of India (RBI) governor has been issuing persistent warnings to banks, non-banking financial companies (NBFCs), and fintechs regarding the alarming surge in unsecured loans.

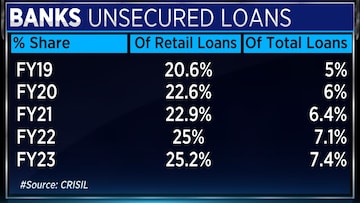

Deputy Governor Swaminathan recently disclosed staggering statistics, revealing that unsecured credit has been growing at a remarkable rate of 23% over the last couple of years, far surpassing other lending categories, which have been growing at a more modest 12-14%.

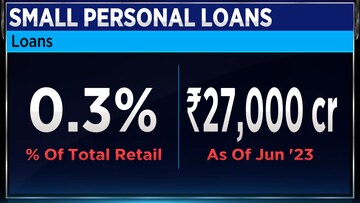

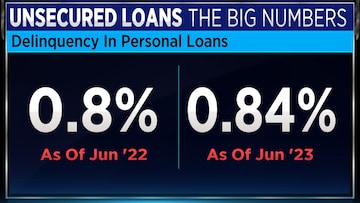

Worryingly, data from the Credit Information Bureau of India Ltd (CIBIL) indicates that non-performing assets (NPAs) in the category of loans valued at less than ₹50,000 have surged to 5.4% as of June 2023, a sharp increase from 4.2% a year ago. Additionally, the number of individuals with four loans in this category has seen a significant uptick. A panel of experts including Jairam Sridharan, Jairam Sridharan, MD of Piramal Finance, Krishnan Sitaraman, Senior Director and Chief Ratings Officer at CRISIL Ratings, and Soumya Kanti Ghosh, Group Chief Economic Advisor at

State Bank of India (SBI), discussed the severity of the unsecured loan problem.

Sridharan, expressing his apprehensions, stated, "The worries are at the same level as when I last spoke maybe 4-5 months ago. I think there is more data now that gives more credence to what we have been thinking about. What we see today is that in the smaller ticket unsecured, risk has clearly started showing. 4-5 months ago, this was speculative. Now it is a fact."

He further emphasized that risk increases as loan amounts decrease, stating, "The smaller you go, the higher the risk has gone. It is expected that the smaller ticket loans will be high-risk, so that is not an issue. The worry is that it has increased."

However, Ghosh of

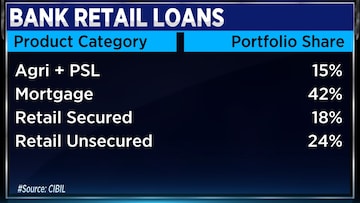

SBI offered a different perspective, suggesting that the concerns may not be as dire as they seem. He pointed out, "While the concerns on this are well appreciated, I think numbers do not suggest any alarm as of now because according to bank credit data for the breakup of unsecured and secured credit, the compositional shift towards unsecured is actually not correct. It is continuing at 10%."

Ghosh argued that both unsecured and secured loans have expanded since the

COVID-19 pandemic.

Sitaraman from CRISIL Ratings explained, "If we look at the unsecured portfolio, I think we can split it into certain categories – one is the less than ₹50,000 ticket size, then we have the ₹50,000 to ₹8 lakh ticket size, and larger than Rs 8 lakh is the last ticket size for a personal loan. In the more than ₹8 lakh category, the numbers are quite steady, the delinquencies are quite under control. Where we have seen some uptick among some of the players is in less than ₹50,000 ticket size. We have seen delinquencies move up there."

For more details, watch the accompanying video

First Published: Oct 26, 2023 5:08 PM IST