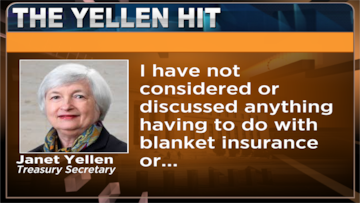

The United States Federal Reserve has brought some finality to the rate cycle. One and done it said, but the market after rising fell probably reacting to US Treasury Secretary Janet Yellen's statement that the government is not looking at any insurance of all deposits. US yields and the dollar have fallen, but so have most equity markets. Therefore, the state of the global economy is a hotly debated topic among experts in the financial industry.

In an interview with CNBC-TV18, Peter Cardillo, Chief Market Economist at Spartan Capital Securities said that after the Fed announcement, he expects the possibility of a recession if the Federal Reserve raises rates again.

He said, “Yes, we are headed for a recession. If they raise one more time, we will probably have a mild recession. But if they up to raise, let's say, by another 50 basis points, then the recession could be more severe.”

According to Cardillo, Yellen's comments also had an impact on the market. He said that Yellen's remarks led to a fall in the market, which could be a sign of investor uncertainty. This highlights the importance of paying attention to economic indicators and policy announcements that may affect the market.

Meanwhile, Geoffrey Dennis, Emerging Markets Commentator discussed the impact of rising rates on the banking sector and according to him, the banking sector has come under pressure due to rising rates. This is because rising rates can make it more expensive for banks to borrow money, which can have an impact on their profitability.

Dennis also believes that the Federal Reserve needs to reassure investors about the stability of the banking sector. This could be achieved through policy announcements and other measures that show that the Fed is committed to maintaining stability in the financial industry. By doing so, the Fed may alleviate some of the concerns investors have about the banking sector.

For the entire discussion, watch the accompanying video