The

Reserve Bank of India (RBI) and its Monetary Policy Committee (MPC) have started their 3-day meeting, leaving market participants eagerly awaiting the outcome. While the consensus is strong that the RBI is unlikely to make changes to interest rates, there is growing speculation about the central bank's stance, driven by recent tough talk and the looming threat of Open Market Operations (OMO) or increased risk weights.

Santanu Sengupta, Chief India Economist at Goldman Sachs echoed the market sentiment, stating, "We also are no different from consensus or other market participants. We do not think the RBI lets its guard down either on liquidity or on the hawkish noise that we have been hearing in the recent past."

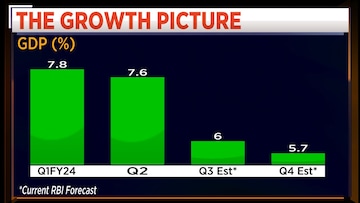

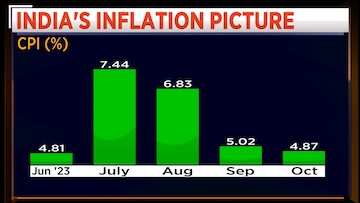

However, Sengupta highlighted some mixed internal factors, emphasising that while consumption has been weaker, investment has been stronger. He expressed concerns about inflation, pointing to multiple upside risks in the current quarter, projecting it to be 6% or higher. Sengupta anticipates a continued hawkish stance from the RBI, including tight liquidity measures and unchanged policy rates.

Neeraj Gambhir, Group Executive and Head of Treasury, Markets and Wholesale Banking Products at Axis Bank concurred with the expectation of prolonged hawkishness.

He emphasised the likelihood of the

RBI continuing its stance of withdrawal of accommodation, anticipating tight liquidity in December. He pointed out that advanced tax outflows and

goods and services tax (GST) outflows could result in a net deficit of ₹2-3 lakh crore in systemic liquidity, keeping short-term money market rates elevated.

According to Sengupta, there will be growth drags, particularly from the fiscal side, in the next year's numbers. "India is still running a fairly high fiscal deficit – 8.5-9% of

gross domestic product (GDP). We think that fiscal consolidation next year will stay the course," he explained, projecting growth around 6.2-6.3% in the next year.

Gambhir expects the RBI to maintain its FY24 inflation forecast.

For more, watch the accompanying video