Home loan equated monthly instalments (EMIs) are set to rise, with the Reserve Bank of India (RBI) increasing key repo rate by 50 basis points (bps) to 5.4 percent. Experts believe that while home loan rates are set to touch a three-year high, people's purchasing power isn't.

This will change the home affordability index, i.e, homes will now become less affordable than they were a year earlier.

"This is the third consecutive rate hike in the last two months and finally marks the end of the all-time best low-interest rates regime, one of the major factors that drove housing sales across the country since the pandemic. Rising home loan rates and construction costs will impact residential sales that did reasonably well in the first half of 2022," Anuj Puri, Chairman, ANAROCK Group, said.

Property demand has been great for the last few months but now both inflation and interest rates — which eat into affordability — have jumped up significantly.

To offset this impact of rising cost of living, as well as rising EMIs, salaries (for the working class) or profits (of the small and medium sized businesses) have to grow, or property prices must fall.

This may not happen now, experts believe.

The appraisal season is over, and we know that salaries have increased for some. Meanwhile, property prices have risen from Rs 4,558 square/feet to Rs 5,941 square/feet pan India in the past 10 years (if we look at the data of residential prices).

| Residential Prices in Top 7 Cities (INR/sq. ft.) |

| City | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | H1 2022 |

| NCR | 4,201 | 4,488 | 4,650 | 4,628 | 4,676 | 4,568 | 4,546 | 4,569 | 4,580 | 4,700 | 4,870 |

| Kolkata | 3,450 | 3,850 | 4,055 | 4,231 | 4,360 | 4,402 | 4,415 | 4,378 | 4,385 | 4,441 | 4,575 |

| MMR | 9,075 | 9,578 | 9,974 | 10,280 | 10,482 | 10,392 | 10,497 | 10,595 | 10,610 | 10,886 | 11,350 |

| Pune | 3,540 | 3,975 | 4,530 | 5,035 | 5,285 | 5,363 | 5,455 | 5,495 | 5,510 | 5,640 | 5,820 |

| Hyderabad | 3,188 | 3,485 | 3,694 | 3,835 | 3,968 | 4,028 | 4,128 | 4,185 | 4,195 | 4,293 | 4,485 |

| Chennai | 4,613 | 4,770 | 4,927 | 5,028 | 4,973 | 4,934 | 4,920 | 4,931 | 4,935 | 5,030 | 5,155 |

| Bangalore | 3,838 | 4,121 | 4,345 | 4,560 | 4,689 | 4,751 | 4,894 | 4,961 | 4,975 | 5,122 | 5,330 |

| PAN India | 4,558 | 4,895 | 5,168 | 5,371 | 5,490 | 5,491 | 5,551 | 5,588 | 5,599 | 5,727 | 5,941 |

(Source: ANAROCK research)

On the other hand, business owners are squeezed between shrinking demand and rising cost of doing business (both in input cost as well as the cost of capital).

According to Madhavi Arora, Emkay Global, the 2022-23 fiscal could further see RBI’s policy rates terminating around 5.75-5.90 percent, with the central bank showing its intent to keep real rates near the estimated natural rate.

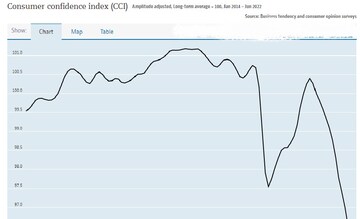

Let's look at the consumer confidence chart here:

(Source: oecd.org)

The consumer confidence index reflects the fears of the average consumer.

Meanwhile, while India may not go into a recession technically, RBI's own projection of 6.7 percent inflation doesn't qualify as strong economic growth, because it's coming off a low base, something that even RBI governor Shaktikanta Das admitted to in his monetary policy statement today.

On the other hand, salaries aren't going to rise for at least another eight months, if not longer. Inflation isn't coming back to 4 percent for the foreseeable future. And, that's just the best-case scenario.

The worst case is a domino effect of a global recession, which has the potential to take the wind out of the Indian economy too.

So that leaves us with cuts in property prices, to keep the momentum up in real estate. But, can developers afford to cut prices at this stage? Because they are also faced with rising cost of materials, wages and what not.

On this, Puri of ANAROCK said that it's not at all possible to go for a price cut now.

"They will infact hike prices, which they cannot afford to not do in light of inflated input costs," Puri said.