The Reserve Bank of India's Consumer Confidence Survey, conducted last month, indicated that the sentiment showed improvement from last year as economic activities picked up pace. However, inflationary pressure kept the index in the pessimistic zone.

The index improved to 75.9 from 71.7 but stayed below 100, which is considered to be in pessimistic territory. Above 100 is considered to be an optimistic situation.

“Consumer confidence for the current period has been consistently improving since July 2021; the sentiments on key parameters like employment and household income improved further in the latest round of the survey, though they remained in pessimistic zone," says the central bank's Consumer Confidence Survey.

Besides the current perceptions in comparison to last year's, the survey touches upon the expectations for the year ahead on general economic situation, employment, income and spending.

According to the survey, that covers 6,027 responses, households expect their spending to increase in the next one year with expenses on essentials going up while they plan to cut down on non-essential expenditure.

Majority of the households are expecting general prices and inflation to remain high over the next one year.

Inflation has been bigger and has risen faster than what the RBI had estimated in April and May, admitted Governor Shaktikanta Das on Wednesday and said it would remain higher than 6 percent till December 2022, mainly due to elevated food prices.

“The Monetary Policy Committee (MPC) notes that continuing shocks to food inflation could sustain pressures on headline inflation. Persisting inflationary pressures could set in motion second-round effects on headline Consumer Price Index (CPI),” Das said on Wednesday.

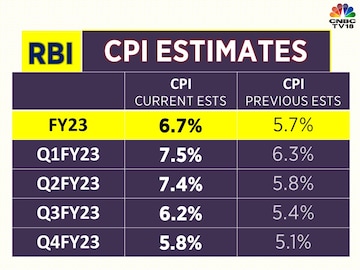

While announcing the central bank’s bi-monthly policy decision, Das said that the MPC had raised the CPI inflation projection for the financial year 2023 to 6.7 percent from the 5.7 percent estimated earlier. This is above the RBI’s inflation target of 4 percent.

The central bank is required to maintain the CPI at 4 percent, with some room to hit the upper limit at 6 percent and the lower limit 2 percent.

The RBI has projected the CPI inflation for the first quarter of FY23 at 7.5 percent against 6.3 percent earlier, while it has estimated it at 7.4 percent against the 5.8 percent projected earlier for the second quarter. For the third and fourth quarters, the CPI inflation is projected at 6.2 percent and 5.8 percent, respectively.

“Since the MPC’s meeting in May 2022, the global economy continues to

grapple with multi-decadal high inflation and slowing growth, persisting geopolitical tensions and sanctions, elevated prices of crude oil and other commodities and lingering COVID-19 related supply chain bottlenecks,” said Das.

The upside risks to inflation persist from elevated commodity prices, upward revision in electricity tariffs, rising pass-through of input costs, the recent spike in tomato prices, and elevated international crude prices, among others, said the RBI.

However, the central bank said that about 75 percent of this massive increase in inflation projections could be attributed to the food basket.

“CPI headline inflation rose further from 7.0 percent in March 2022 to 7.8 percent in April 2022, reflecting a broad-based increase in all its major constituents. Food inflation pressures accentuated, led by cereals, milk, fruits, vegetables, spices and prepared meals,” it said.

The retail prices of tomatoes in major metro cities went up to nearly Rs 80 per kg recently owing to supply concerns as the produce has been impacted due to heat waves in tomato-growing states like Maharashtra, Karnataka, and Andhra Pradesh.

Several other vegetable prices, including potato rates, also stood above the last year’s levels in the first week of June.

The RBI on June 8 announced a hike of 50 basis points in the repo rate — the key interest rate at which the central bank lends money to banks — to 4.9 percent. The monetary policy committee voted unanimously to raise the repo rate and decided to remain focused on withdrawing its 'accommodative' stance to ensure inflation stays within target levels going forward while supporting growth.

First Published: Jun 8, 2022 11:02 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 35% voter turnout recorded by 1 pm

Apr 26, 2024 9:11 AM