Home

Terms and Conditions

RBI Monetary Policy Meeting Highlights: Here's the impact analysis by top economists

Live Updates

RBI Monetary Policy Meeting reactions: Here's the impact analysis by top economists

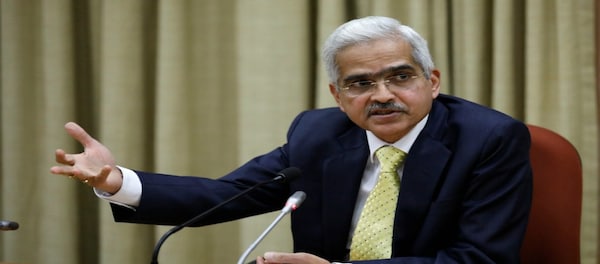

After Reserve Bank of India's two-day monetary policy committee (MPC) meeting, Governor Shaktikanta Das announced that the MPC has unanimously decided to keep the repo rate unchanged at 6.5 percent, as announced in the June policy, with the preparedness to act should the situation so warrant. Read more here

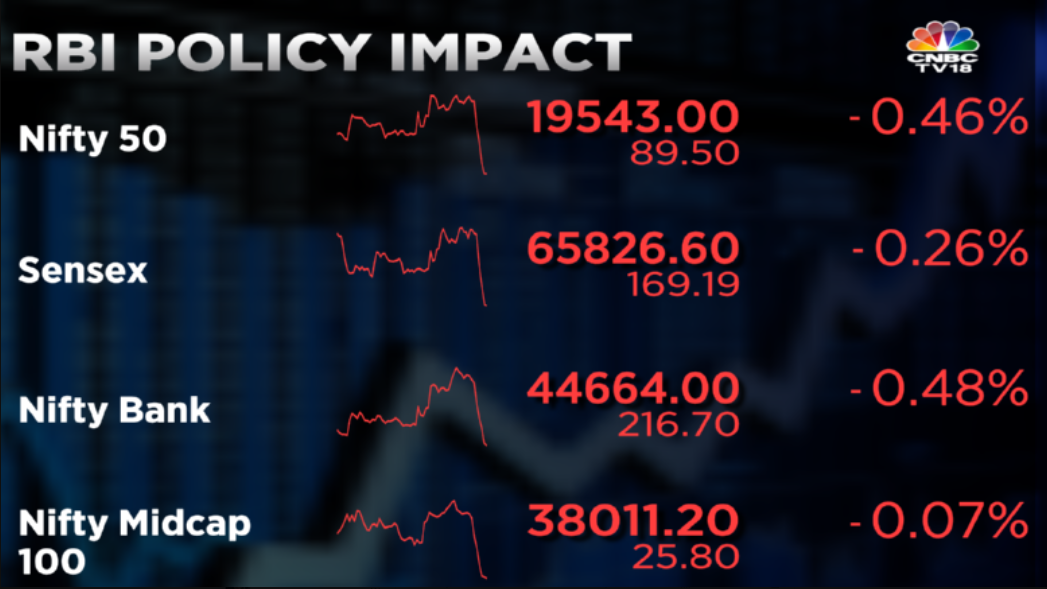

Nifty, Bank Nifty dip as RBI asks banks to set aside incremental CRR

Key stock indices such as Nifty50, Nifty Bank and auto declined up to 0.79 percent after the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) raised the inflation target for financial year 2023-24. Read more here

RBI move may suck more than Rs 1 lakh crore from the banking system

The Reserve Bank of India has asked banks to park an additional 10 percent of Net Demand and Time Liabilities (NDTL), garnered between May 19 and July 28, as incremental cash reserve ratio from August 12. The move may suck out more than Rs 1 lakh crore from the banking system. Read more

RBI Monetary Policy Meeting reactions: There's more upside risk to inflation in the absolute near term, Upasna Bhardwaj Senior Economist at Kotak Mahindra Bank.

"Broadly, if I look at the policy, decisions have been broadly in sync with what we have been anticipating. Our revised estimates for inflation after the vegetable led inflation has been 5.4 percent. So the headline number does look in-line but I think internally, if I was to look at the quarterly profiles, the 6.2 percent does have an upside risk. I think the near term risk to this quarter is much higher. While the last quarter estimates RBI has preferred to keep that unchanged, my sense is that will be revised downwards eventually. So internally, I think there is much more upside to the near term. Going beyond FY24, we are at 5 percent inflation. So clearly, I think higher for longer is what the governor did emphasize maybe in the global context, but that also remains the key even domestically. We do not look at a possibility of a rate cutting cycle happening anytime this financial year, we will have to, again, evaluate the conditions going ahead into the next year. But at the moment, I think there's more upside risk to inflation in the absolute near term," said Upasna Bhardwaj Senior Economist at Kotak Mahindra Bank.

RBI Monetary Policy Meeting LIVE: Recent spike in inflation is expected to be short lived

Recent spike in inflation is expected to be short lived. Incremental CRR is a purely temporary measure, will be reviewed before or by September 8, says

RBI Governor, Shaktikanta Das, in Post Monetary Policy Press Conference.

RBI Monetary Policy Meeting LIVE:

"At times, pressures are there on liquidity due to overall surplus, due to withdrawal of Rs 2000 bank note," says RBI Governor.

RBI Monetary Policy Meeting LIVE: RBI says you can soon make UPI payments through conversations — here's how

The RBI has announced conversational payments on UPI, which will allow users to engage in natural language conversations with an AI-driven system, streamlining the process of initiating and completing transactions.

While announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said that this channel will be accessible through both smartphone and feature phone-based UPI platforms, ensuring a broader reach and deeper digital penetration. Initially launching in Hindi and English, the feature is slated to expand to encompass a variety of Indian languages, catering to a wider spectrum of users.

Kisan Credit Card | RBI's new interest subvention rates on farm loans — Who's eligible, how to apply and key details

The RBI has recently said that the interest rate for short-term loans up to Rs 3 lakh through Kisan Credit cards (KCC) will be 7 percent and interest subsidy will be 1.5 percent for the current financial year (FY23) and next financial year (FY24).

Also, an additional interest subvention of 3 percent per annum will be provided to the farmers repaying in time, subject to a maximum period of one year from the date of disbursement.

RBI Monetary Policy meeting LIVE | KCC loans: RBI aims at public tech platform for frictionless credit delivery

The RBI said a platform for frictionless credit delivery through digital process used in Kisan Credit Card (KCC) will be made available for other loans to deepen financial inclusion.

For digital credit delivery, the data required for credit appraisal are available with different entities like the Central and the state governments, account aggregators, banks, credit information companies, digital identity authorities, etc.

RBI Monetary Policy meeting LIVE: RBI to enable borrowers to reset home loan rates whenever they want to

The RBI has proposed to put in place a transparent framework for resetting of interest rates on floating rates. While announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said that the framework will focus on clearly communicating to borrowers any reset in schedule of loans and quantum of EMI.

"The framework will review options that need to be provided to switch to fixed rate loans or for foreclosure of loans," Das said.

Get all details here

RBI Monetary Policy meeting LIVE: Latest announcements on UPI

-Propose to enable conversational payments in UPI

-Introducing offline payments in UPI using near-field tech via UPI Lite

-Enhancement transaction limit for small value payments from Rs 200 to Rs 500 in offline mode

Non-policy measures announced by RBI

-Review of rthe egulatory framework for IDF-NBFCs to augment capacity for infra financing

-Greater transparency in interest rate reset in EMI-based floating rate loans

-Consolidation and harmonisation of instructions for supervisory returns to reduce the compliance burden

RBI Monetary Policy Meeting LIVE: Expect CAD to remain manageable, says Das

Governor Das said, buffers are best built up during good times and RBI remains steadfast in its commitment to safeguard the system from potential and emerging challenges.

India’s CAD was contained at 2 percent of GDP in FY23 and it is expected to remain eminently manageable during the current financial year, he said.

RBI MPC increases FY24 inflation forecast to 5.4% from 5.1%

The Reserve Bank of Inida's Monetary Policy Committee (MPC) has increased its CPI inflation forecast for FY24 to 5.4 percent from 5.1 percent, governor Shaktikanta Das said on Thursday, August 10.

However, the governor said that the central bank is firmly focused on aligning inflation to the target of 4 percent. "MPC remains resolute in its commitment to align inflation with the 4 percent target and anchoring inflation targets," said RBI Governor Shaktikanta Das.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|