The Reserve Bank of India's Monetary Policy Committee (MPC) has lowered its CPI inflation forecast for FY24 to 5.1 percent from 5.2 percent, Governor Shaktikanta Das said on Thursday, June 8.

For the first quarter, the RBI has projected the CPI (consumer price index) inflation to be 4.6 percent, 5.2 percent for the second quarter, 5.4 percent in the third quarter and 5.2 percent in the fourth quarter.

"With the policy repo rate at 6.5 percent and full-year projected inflation for FY24 at just a little above 5 percent, the real positive rate continues to be positive," he said.

"With the recent rabi harvest remaining largely immune to the weather events, the near-term inflation outlook looks more favourable than the last MPC meeting in April. Uncertainties remain on the distribution of monsoon and the interplay between El Niño and the Indian Ocean Dipole. Geopolitical tensions, uncertainties around the monsoon and international commodity prices, especially sugar, rice and crude oil, and volatility in financial markets, pose upside risks to inflation," he said.

The CPI inflation projection of 5.1 percent was arrived at after assuming these factors and a normal monsoon.

'Headline inflation still above target'

Das said inflation continues to rule above targets across the world.

The RBI governor said the headline inflation has been projected to remain above 4 percent throughout FY24. He said the CPI in March eased and moved into tolerance band. "Headline inflation is still above target as per latest data and is expected to remain so according to our projections for FY24," he said.

"We have made good progress in containing growth, supporting inflation and maintaining financial and external sector stability. Despite three years of global turmoil, India's growth has bounced back and headline CPI inflation is easing," he said.

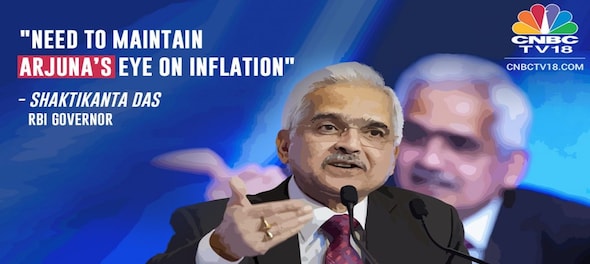

However, Das said that given the uncertainties it is important to maintain an 'Arjuna's eye' on the inflation scenario.

"Nevertheless, we need to move towards our primary target of 4 percent inflation. It is always the last leg of the journey which is the toughest. I wish to emphasize we will do whatever is necessary to ensure long-term inflation expectations remain firmly anchored," he added.

Experts speak

Neeraj Gambhir of Axis Bank said the RBI conitnues to be very focused on getting inflation aligned with the 4 percent target. "So I do think that if any rate cut, then it should somewhere close to February or March next year. But that will be highly contingent upon many other things playing out such as growth, momentum weakening," he said, adding that if growth continues to be strong, inflation continues to be closer to 5 percent.

Soumya Kanti Ghosh, Group CEA, State Bank of India believes aligning inflation with 4 percent is a smart way of communicating to the market that it should not run away with a rate cut expectation at a future date.

Rajiv Mohan, President-Treasury & Global Marksts, Kotak Mahindra Bank, said RBI has been quite clear that inflation remains the primary focus and they have been "harping" on the fact that risks are evenly -balanced. "Despite that, the policy before the ladt one, the fourth quarter inflation was at 5.6 percent, which was then brought down to 5.2 percent and held there. But the number from 5 percent for quarter one is now at 4.6 percent. I think they are seeing inflation moderating, but they would like to see more of it. And Governor kept stressing on the fact that it has to be sustainable. Having said that, I would expect all central banks to be wanting to support growth, but inflation somehow remains their passion. So they would want to be guarded and data dependent," Mohan said.

Anubhuti Sahay of Standard Chartered Bank, thinks the caution on inflation is well-justified. "And if you look at the RBI's forecast, the full-year forecast adjustment is simply a technical adjustment taking into considerations the downside surprises in the first quarter. But if you look at the third and fourth quarters, it has remained unchanged, which effectively to me gives a message that they are not extrapolating the recent downside surprises to the projection of the second-half inflation." Sahay said.

First Published: Jun 8, 2023 10:16 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM