By CNBCTV18.com | Feb 8, 2024 4:51 PM IST (Updated)

RBI MPC decision LIVE: Anurag Mittal, Head of Fixed Income at UTI AMC reacts on monetary policy announcement

“By keeping the monetary policy unchanged, the RBI today clearly distinguished between the “needs” & the “wants” of the bond market. The RBI appropriately maintained the monetary policy discipline & assertively indicated its preference to remain on hold till they get more confidence on sustainably reaching their inflation target. We believe it’s more important to focus on magnitude of rate cuts rather than timing. We continue to believe that conditions for fixed income are increasingly turning favourable & we continue to expect 50-75bps rate cuts for CY24.”

RBI MPC decision LIVE: Aamar Deo Singh, Sr. Vice President, Research, Angel One reacts on RBI policy decision

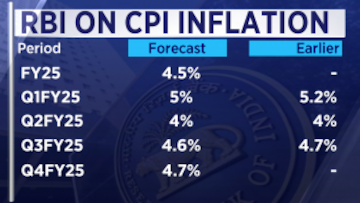

“The benchmark interest rate remained unchanged at 6.5% in the RBI’s most recent monetary policy announcement today. The RBI decided not to change the rates at this time because retail inflation for FY24 was 5.4%, above the targeted rate of 4%. A rate reduction in FY25 appears likely given the upcoming MPC meeting, which is set for April 3-5, 2024, and the anticipated cooling of retail inflation to 4.5% in FY25.”

RBI MPC decision LIVE: Puneet Pal, Head- Fixed Income, PGIM India Mutual Fund reacts on RBI policy decision

“The MPC meeting today maintained the status quo on policy rates and the monetary policy stance. Some sections of the market were expecting a change in stance which did not materialize though, in our view, the policy was dovish as Prof Jayant Varma voted for a rate cut and with the governor highlighting the underlying financial stability and FY25 Inflation forecast at 4.50% which is 200 bps below the policy repo rate. We think the monetary policy stance will be changed in the next MPC Policy in April 2024.”

RBI MPC Meeting 2024 LIVE updates: Lakshmi Iyer, CEO-Investment & Strategy, Kotak Alternate Asset Managers reacts on RBI policy decision

Lakshmi Iyer, CEO-Investment & Strategy, Kotak Alternate Asset Managers Limited said, “Status quo in rates and stance in line with our and market expectations. No major worries expressed on inflation front is comforting, but for food price fluctuations – the watch for global cues however continues. While FY 25 inflation forecast is at 4.5%, as per RBI the last mile walk is very crucial, hence the walk towards headline CPI of 4% is key for RBI.

Liquidity life line from RBI to the banking system may continue as Q4 tends to be tight one due to advance tax outflows, as also the impending general elections, which could also see currency in circulation going up. We expect bond yields to trade in a tight range tracking US bond yields. Foreign buying of govt bonds is likely to keep buoyancy in bond yields intact, despite near term upticks if any. Investors may look to add duration to ones fixed income portfolio on price dips.”

RBI MPC Meeting 2024 LIVE updates: Uttam Tibrewal, Executive Director, AU Small Finance Bank reacts on RBI MPC 2024

“RBI’s policy was on expected lines with a focus on bringing inflation towards a targeted range of 4%. Monetary policy stance and steady rates over the last one year have helped maintain healthy growth momentum while lowering inflationary pressures. Going forward, we believe that as inflation nears RBI’s 4% goal, space for monetary easing would open up in the coming quarters, to support lower interest rates and credit demand.”

RBI Monetary Policy Live Updates | One estimate of the amount of cash that India's banking system needs

India’s banking system needs ₹3.5-4 lakh crore cash next financial year ending March 2025, according to R Sivakumar, Head Fixed Income, Axis AMC. Of that, he estimates, ₹2 lakh crore will come once India’s bonds included in the JPMorgan global index. “We still need somewhere in the range of 1 to 2 lakh crore of excess liquidity that the RBI will have to figure out some way of infusing,” he said responding to Governor Shaktikanta Das perceived reluctance to ease the liquidity deficit in the system right now. One that, Das acknowledged, has come about for the first in time over four years.

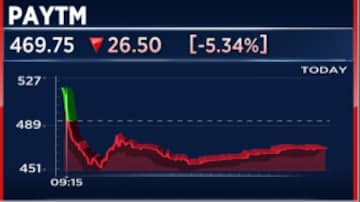

RBI Monetary Policy Live Updates | Paytm shares down 10% again

“There were issues of compliance on not just KYC but many aspects of regulatory requirements,” RBI Deputy Governor Swaminathan J said. Read on to know more.

RBI Monetary Policy Live Updates | Paytm shares down 10% again

“There were issues of compliance on not just KYC but many aspects of regulatory requirements,” RBI Deputy Governor Swaminathan J said. Read on to know more.

RBI Monetary Policy Live Updates | Four banks have hiked fixed deposit interest rates in February

Axis Bank, Punjab National Bank (PNB), HDFC Bank, and IndusInd Bank have all adjusted their FD rates. These changes came in before the RBI monetary policy review. Check which one offers a better deal for savers.

RBI Monetary Policy Live Updates | Banks must reveal the entire cost of a loan including fees and other charges

Some of the charges levied by banks are one time while others are recurring charges that may levied every year. Lenders may have to specify the impact of the recurring charges too. Read more about the incoming regulation here.

RBI Monetary Policy Live Updates | The gravity of Paytm crisis

“Why should we act if an entity complies with regulation? We are a responsible regulator,” says RBI Governor Shaktikanta Das. Read the full text of his response to the question about what went wrong at Paytm.

RBI Monetary Policy Updates LIVE | Why Governor wants banks to increase lending rates further

RBI MPC Meeting 2024 LIVE updates: RBI Governor on Paytm

RBI On #Paytm | We impose supervisory restrictions when a regulated entity doesn’t take corrective action. All our actions are in interest of systemic stability, says Shaktikanta Das, Governor, @RBI on @Paytm. Adds #RBI to issue FAQ on Paytm restrictions next week. pic.twitter.com/RvSTy9bAyk

— CNBC-TV18 (@CNBCTV18News) February 8, 2024

RBI MPC Meeting 2024 LIVE updates: RBI proposes framework for authentication of digital payments

Among additional measures, Das said SMS-based OTP has become very popular as AFA (additional factor of authentication) and therefore to enhance security of digital payments, the MPC has proposed to put in place a principle based framework for authentication.

RBI MPC Meeting 2024 LIVE updates: RBI Deputy Guv on Paytm

#RBIPolicy | ‘Supervisory action was a result of persistent non-compliance’. #RBI Gov Swaminathan J speaks about RBI’s action against #Paytm; says RBI will ensure that customer inconvenience is minimized pic.twitter.com/Ewg5nRuvcM

— CNBC-TV18 (@CNBCTV18Live) February 8, 2024

| Currency | Price | Change | %Change |

|---|