The Reserve Bank of India did not hike its lending rate (repo rate), in line with the consensus expectations of market watchers and economists.

Decision to take keep the

rates unchanged was taken unanimously. The Monetary Policy Committee also decided by a 5:1 majority to remain focused on "withdrawal of accommodation."

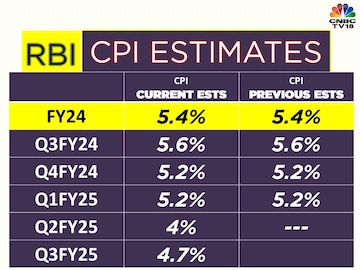

This essentially means that the central bank will continue with its efforts to tame inflation with interest rate hikes, if needed. The RBI expects inflation to remain higher than its comfort level through this financial year ending March 2024.

The long-awaited normalcy awaited by the global economy still remains elusive, the Governor said as he began his speech. The global economy is showing signs of slowdown although in specific geographies and specific sectors.

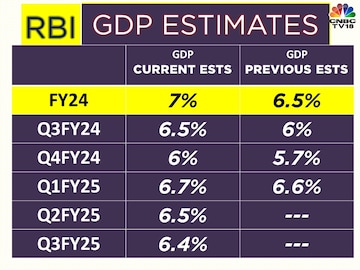

India's central bank decided to increase the country's GDP growth estimates for financial year 2024 to 7% from the earlier estimate of 6.5%. Estimates for the final two quarters of financial year 2024 were also revised higher.

RBI Deputy Governor Michael Patra told reporters that the GDP data collected for the months of October and November is very robust and that the financial year 2024 revised GDP target of 7% is a conservative estimate.

The Governor also disclosed inflation projections for the September and December quarters of financial year 2025 at 4% and 4.7% respectively.

"This is slightly higher than what we were expecting. But I think we will have to wait and watch. We will have to see how the high frequency data in the next quarter also pans out. For us to have a much more firmer call for the fourth quarter. Third quarter clearly looks to be doing good," said Upasna Bharadwaj, Senior Economist at Kotak Mahindra Bank.

Marginal Standing Facility (MSF) and Standard Deposit Facility (SDF) rates have been left unchanged at 6.75% and 6.25% respectively.

The Governor noted that there has been a higher utilisation of both MSF and SDF facility by the banks and in order to address the situation, the central bank has proposed to allow reversal of liquidity facilities in both SDF as well as MSF during weekends and holidays with effect from December 30, 2023.

"The measures announced by the governor are extremely positive in terms of making the reversal of liquidity facilities both weekends and holidays – this long-standing demand from the industry, we are glad that it has been implemented though it will be reviewed after six months, it definitely eases the liquidity management at the bank," SBI MD CS Setty told CNBC-TV18.

The RBI has also decided to come out with a unified regulatory framework on connected lending for all regulated entities.

Additionally, in some of the other decisions taken by the RBI, the UPI payment limit for hospitals and education payments has been revised higher to ₹5 lakh per transaction from the earlier limit for ₹1 lakh per transaction.

"From being a part of fragile 5 some time back to having GDP growth revised upwards to 7% when global growth has become fragile is the summary of the good work done by the RBI and the government in the most challenging times," said Nilesh Shah of Kotak Mahindra AMC.

In an address to reporters, the Governor said that it will be wrong to assume that any kind of loosening is around the corner and it will also be wrong to assume that the MPC is moving towards a "neutral" stance.

"For now, we continue to expect the RBI to start its rate cut cycle not before the June/August policy in 2024," Abheek Barua of HDFC Bank was quoted as saying.

First Published: Dec 8, 2023 10:05 AM IST