Home

Terms and Conditions

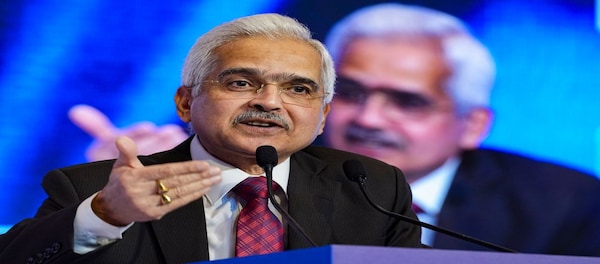

RBI MPC Meeting Highlights | Nearly 85% of Rs 2,000 notes have come back as deposits to banks, says Shaktikanta Das

Live Updates

RBI MPC key highlights

- MPC Voted Unanimously to leave Repo Rate Unchanged at 6.50%

- MPC decided by a 5:1 majority to remain focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth

- Prof Jayanth Varma voted against MPC’s stance resolution

- CPI forecast for FY24 lowered marginally to 5.1% from 5.2% earlier

- CPI forecast for 1H FY24 lowered, maintained for 2HFY24

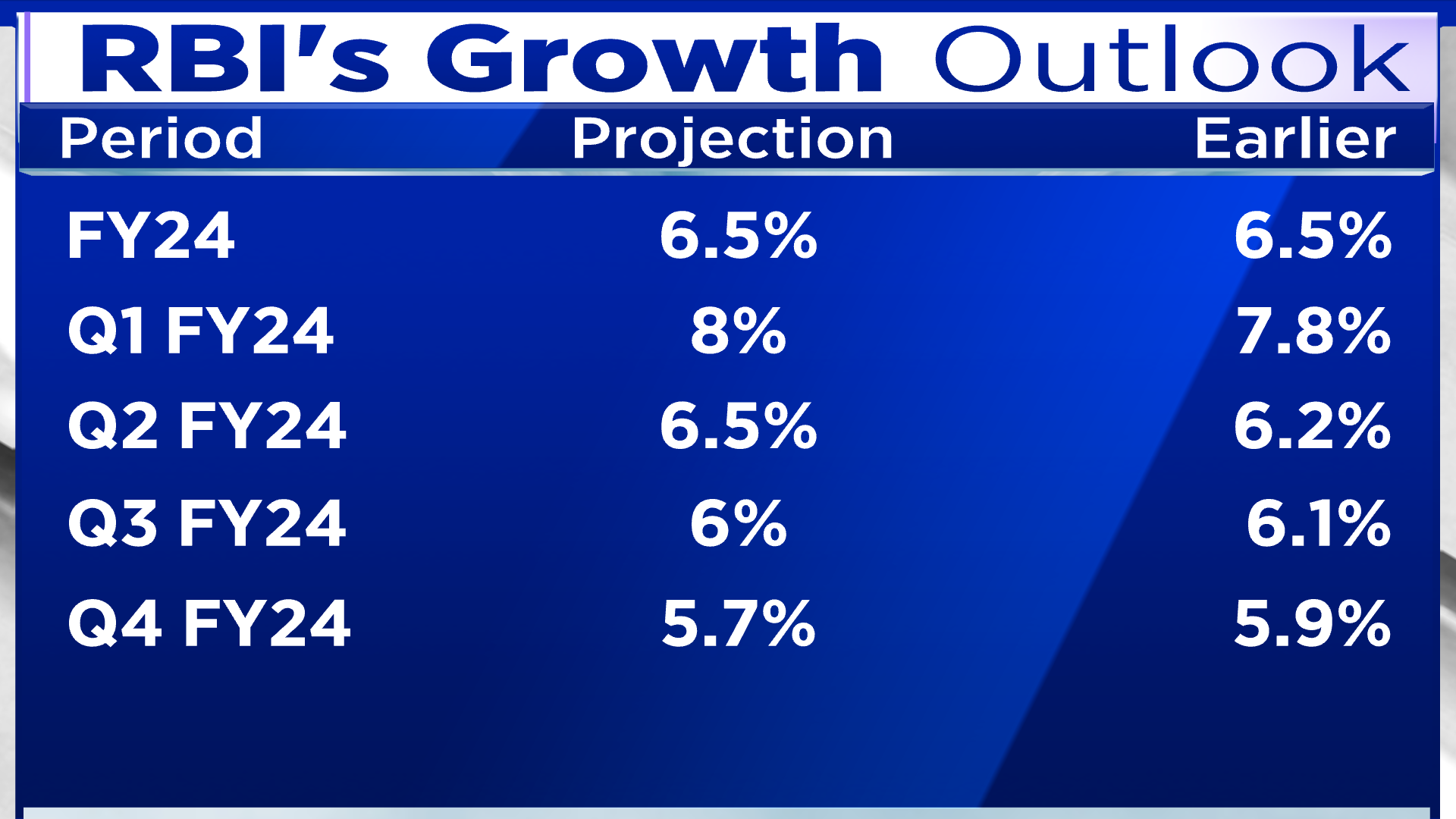

- GDP forecast for FY24 left unchanged at 6.5%

- GDP forecast raised for 1H FY24, and lowered for 2HFY24

RBI MPC meet: Plan to have 1 million CBDC customers by June end, says deputy governor Rabi Shankar

Deputy Governor T Rabi Shankar said that the Reserve Bank of India (RBI) aims to achieve one million customers for its central bank digital currency (CBDC) by the end of June. While no specific date was mentioned for the public launch of the CBDC, Shankar stated that the target is to reach the milestone by the conclusion of June.

The CBDC trials for both the wholesale and retail segments were initiated on November 1, 2022, and December 1, 2022, respectively.

Positive outlook for the Indian economy, indicates that inflation has been kept in check: Emami Realty MD & CEO Nitesh Kumar

"RBI today kept its benchmark policy rate at 6.5% for the second time since it announced a rate pause in April. The report gives an indication of a positive outlook for the Indian economy and indicates that inflation has been kept in check. Since retail inflation has reached an 18-month low, a downward adjustment to the rate was expected; however, a consecutive pause may help manage inflation and ease the pressure on consumers," he said.

Worst over for home loan borrowers, but...

Home loan interest rates may start dropping before the end of 2023, experts said after the RBI maintained a status quo on the repo rate as well as its policy stance. Although inflation still remains higher than the tolerance level, it has decreased over the past few months, allowing the RBI to maintain its stance.

Experts believe this status quo will facilitate positive decision-making for homebuyers and lenders.

MSP hikes will impact inflation by 10-12 bps: RBI DG Michael Patra

RBI DG Michael Patra told the media that the MSP hikes announced yesterday will impact inflation by 10-12 basis points.

RBI MPC meeting presser LIVE: Nearly 85% of Rs 2,000 notes have come back as deposits to banks: Shaktikanta Das

About Rs 1.80 lakh crore of Rs 2,000 banknotes have come back, roughly about 50 percent of the notes in circulation before the announcement, Governor Shaktikanta Das told reporters on June 8.

He added that approximately 85 percent of Rs 2,000 notes that have come back are as deposits to banks, which is in-line with expectations.

He advised the citizens to patiently visit banks and get their notes exchanged or deposited but avoid last minute rush in the last 10-15 days of September.

RBI rate pause lifts markets

Frontline indices S&P BSE Sensex and Nifty 50 were largely steady after sentiments improved as RBI hit the pause button again and decided to keep the key benchmark policy rate (repo rate) unchanged at 6.5 percent on June 8.

While the Sensex was trading at 63,321.40, up by 150 points, the broader market Nifty50 rose to 18,770.50, higher by 44 points or 0.24 percent.

Read on to how the markets are reacting to the RBI announcements

How Indians travelling abroad will benefit from new RBI move

RBI Governor Shaktikanta Das has announced said RuPay debit and credit cards issued by the banks in India are gaining increased acceptance abroad hence it has been decided to permit issuance of RuPay prepaid forex cards by the banks.

"This will expand the payment options for Indian travelling abroad. Further the RuPay cards will also be enabled for issuance in foreign jurisdiction these measures will allow and acceptance of rupee cards globally," he said.

If you were hoping for a RBI rate cut in October, you'd be disappointed, says this economist

Kaushik Das, Chief Economist, Deutsche Bank says that his takeaway from the inflation forecast is that RBI is not going to cut rates anytime soon.

“If you see October-December is at 5.4 percent, January-March next year is at 5.2. And we know that the Fed is probably going to hike in July. And probably the Fed will only cut in March of next year. So, whoever was expecting or if markets were expecting that October-December RBI could move by cutting rates, we do not see any reason why RBI should,” he said.

RBI MPC Live: How will e-rupee vouchers reach more users

The RBI has proposed to enable the issuance of e-rupee vouchers on behalf of individuals and to simplify the process of issuance, redemption and a few aspects of the current framework.

This measure will make the benefits of e-rupee digital vouchers accessible to a wider set of users and further deepen the penetration of digital payments in the country, said RBI Governor Shaktikanta Das said while announcing the bi-monthly monetary policy.

RBI proposes to expand the reach of e-rupee vouchers to PPIs

Das announced that the central bank's MPC has proposed to expand the scope and reach of e-rupee vouchers to PPIs and the enabling of issuance of e-rupee vouchers on behalf of individuals.

This will further deepen the penetration of digital payments in the country, he said.

Banks can now issue Rupay prepaid forex cards: RBI Guv

RBI MPC has decided to permit the issuance of Rupay prepaid forex cards by banks, Governor Shaktikanta Das said, adding that the cards also be enabled for issuance in foreign jurisdictions.

"These measures will help expand Rupay cards’ reach globally," he said.

Situation remains favourable for home loan takers

Given the current unchanged rates, the outlook for those looking to buy their first home via a home loan soon remains favourable. Interest rates from most banks will continue in the single digits. With top banks, they currently hover between 8.7 to 9.65 percent. A future rate hike, if any, may push the rates into double digits.

"The persisting financial instabilities in advanced economies of the world may have repercussions in India, causing the RBI to take such a step to face these headwinds," Das said.

RBI MPC Meeting Live: Need to maintain Arjuna’s eye on inflation scenario, says Das

RBI Governor Shaktikanta Das reiterated the need to maintain Arjuna’s eye on the inflation scenario as headline inflation still remains above the target of four percent.

The last leg of the journey is always the toughest, he said, adding "will do whatever necessary to ensure long-term inflation expectations remain anchored...we will remain watchful and proactive in dealing with emerging risks to price and financial stability."

FY24 GDP growth projection unchanged at 6.5%, check quarterly forecast here

RBI has maintained the real GDP forecast as estimated earlier in April at 6.5 percent on the back of higher Rabi crop output, moderating commodity prices, monsoon trajectory and the government's plan of higher capital expenditure.

Additionally, the FY24 GDP projections for the second half of the year have been lowered marginally, while for the first half it has been raised from earlier projections.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|