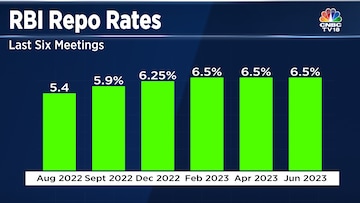

The Reserve Bank of India will not hike its lending rate (repo rate), in-line with consensus expectations of market watchers and economists. The repo rate will remain unchanged at 6.5 percent, as announced in the April policy. A CNBC-TV18 poll had expected the Monetary Policy Committee to maintain status quo.

The standing deposit facility (SDF) rate is unchanged at 6.25 percent. Moreover, the marginal standing facility (MSF) and bank rates have also been left unchanged.

RBI's Monetary Policy Committee voted unanimously in favour of maintaining status quo on interest rates. It also voted in a 5:1 majority on the withdrawal of accommodation to ensure inflation aligns with the target while focusing on growth.

"The MPC has raised repo rates by 250 basis points since May last year, the effects of which will be seen in the coming months," Governor Das said while explaining the rationale behind keeping policy rates unchanged.

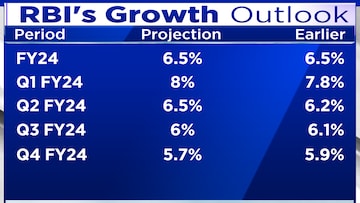

India's central bank has also maintained India's GDP growth estimate for financial year 2024 at 6.5 percent. For the first two quarters of the financial year 2024, the RBI has hiked GDP growth projections, while marginally cutting the same for the next two quarters.

The markets continue to edge higher as the RBI Governor continues to spell out the monetary policy. The Nifty 50 index is trading above the mark of 18,750, up 0.2 percent. On the other hand, the Nifty Bank index is just 70 points away from its all-time high of 44,498, which it scaled last month.

In another important development, the Reserve Bank of India lowered its financial year 2024 inflation forecast to 5.1 percent from 5.2 percent earlier. For the June quarter, the projection is at 4.6 percent.

The governor said that forecast of a normal monsoon augurs well for the Kharif crop. However, he cautioned that geopolitical tensions, monsoon uncertainty and volatility in global financial markets pose an uspide risk to inflation.

The governor also proposed to expand the scope and reach of e-rupee vouchers to PPIs and to enable the issuance of e-rupee vouchers on behalf of individuals.

First Published: Jun 8, 2023 10:07 AM IST