The significant surge in US yields and crude oil prices has likely stabilised for now. However, the Monetary Policy announcement on October 6 by the

Reserve Bank of India (RBI) and its six-member Monetary Policy Committee (MPC) is expected to be influenced by the market's recent unpredictability over the past month.

A

CNBC-TV18 poll suggests the market unanimously does not expect a change in rates or the stance.

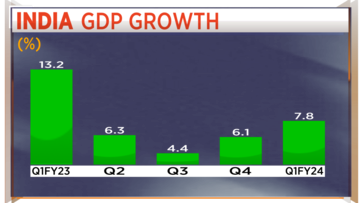

In the last policy announcement made on August 10, Shaktikanta Das, the Governor of the Reserve Bank of India, retained the real GDP forecast of 6.5% for the fiscal year 2024. This was backed by the expectation of robust growth in both rural and urban regions, increased investment activity, and the government's commitment to boost capital expenditure.

In an interview with CNBC-TV18, Ashhish Vaidya, Head of Markets at DBS Bank India and Suyash Choudhary, Head-Fixed Income at Bandhan MF spoke at length about what the policy conveys; given the recent volatility in US yields will tighten liquidity to keep short-term rates high and what else should one watch out for.

Vaidya said DBS Bank India does not anticipate any alterations in rates in the

upcoming RBI policy. His company holds the view that the RBI will maintain tight liquidity, and the focus will be on reducing liquidity levels.

“We are not expecting any change in rates as such, but liquidity is going to be at the center of the policy and they will continue to keep the liquidity tighter,” he said.

Choudhary concurred the emphasis will remain on liquidity. He expects the short-term steps taken by the RBI to address liquidity issues to persist. At this point, he doesn't believe the RBI would be inclined to raise interest rates.

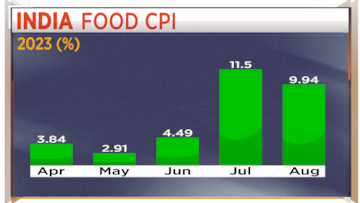

He added that given the current market dynamics, it is challenging to envision inflation falling below 5%. “It is hard to see inflation below 5% sustainably given the repeated food shocks that the RBI also refers to from time to time, as well as the volatility that you are seeing in the commodity market,” said Choudhary.

For the entire discussion, watch the accompanying video

(Edited by : Shweta Mungre)