The Reserve Bank of India (RBI) is set to announce its monetary policy on Friday, December 8. A CNBC-TV18 poll, as well as experts, indicated no hike or change in stance.

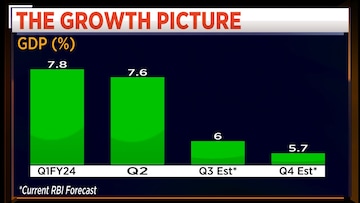

Pronab Sen, a Former Chief Statistician, expressed concerns about the current economic momentum, describing it as "weakish". "The growth story isn't quite as good as the headline numbers make it out to be. The momentum is not great at all. In fact, it's weakish. Growth is something that they will have to keep their eyes on," Sen said.

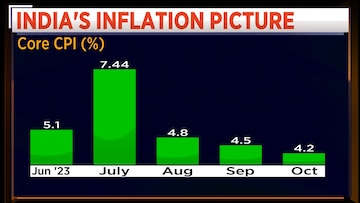

While acknowledging that inflation is currently under control, Sen warned of potential challenges ahead. He mentioned, "I would imagine that the job of the MPC (Monetary Policy Committee) isn't quite as difficult as you make it out to be. I think they are going to have to manage both inflationary possibilities and try and build up the growth momentum. Otherwise, growth is going to drop down very sharply in the coming quarters."

Samiran Chakraborty, Chief India Economist at Citi, echoed Sen's sentiments. He noted that despite some positive economic indicators, there are concerns about a two-paced economy.

Chakraborty highlighted, "If you look into the details of the growth number, it's a two-paced economy. There is the infrastructure, construction, manufacturing, sort of, if you may want to call it the investment side of the economy, which is doing much better. But if you look at the consumption side, that's much weaker."

Chakraborty also pointed out challenges in the informal sector within the GDP and identified a problem with food inflation. He mentioned, "If you even look at the different proxy indicators of what we can call the informal sector within the GDP number that has been surprising on the downside."

However, he expressed scepticism about solving the issue of food inflation through monetary policy.

Soumya Kanti Ghosh, Group Chief Economic Advisor at the

State Bank of India, emphasised the need for caution, particularly regarding food inflation. Ghosh stated, "We need to remain cautious because food inflation is still a concern, and will remain a concern if you look into the change of the price behaviour in the market in the last couple of months."

In the global context, Sajjid Chinoy, Chief India Economist at JPMorgan, provided a more optimistic outlook for the coming year. He noted a potential relief, stating, "Ending this year, there's a little bit of relief, that maybe just maybe 2024 may not see a hard landing."

Chinoy acknowledged that global growth is slowing but suggested that it might not be as sharp as feared. He also highlighted factors such as lower crude prices, making the global environment less hostile for India.

Chinoy said, "Last thing I will say from India's perspective, even crude prices, which are above 90 and now below 80 because oil suppliers are struggling to coordinate. So lower US rates,

a weaker dollar, lower crude prices make for a much less hostile global environment that we had to contend with two months ago."