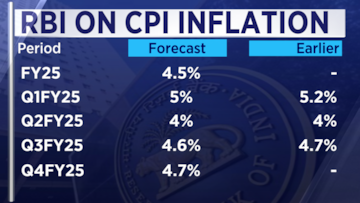

The Reserve Bank of India, on February 8, kept its consumer price index (CPI) inflation forecast for the current financial year (FY24) unchanged at 5.4%. The central bank estimates the headline inflation for the next financial year (FY25) at 4.5%.

In its first monetary policy for 2024, the RBI's Monetary Policy Committee (MPC) alsorevised its projection for inflation for fourth quarter of FY24 (Q4FY24) downward to 5.0% from 5.2%.

Inflation has softened considerably and we expect it to moderate further in 2024, RBI Governor Shaktikanta Das said while announcing the policy.

"On the inflation front, large and repetitive food price shocks are interrupting the pace of disinflation that is led by the moderation of core inflation. Geopolitical events and their impact on supply chains, and volatility in international financial markets and commodity prices are key sources of upside risks to inflation," he said

Das highlighted that the last mile of disinflation is always the most challenging, reiterating that stable and low inflation will provide bedrock for sustainable economic growth.

The MPC also left the policy rate unchanged, at 6.5%, for the sixth consecutive time. Consequently, Marginal Standing Facility (MSF) rate stays at 6.75%. MSF is the rate at which banks borrow overnight funds from RBI against government securities.

The MPC maintained the 'withdrawal of accommodation' stance aimed at controlling inflation and stabilising the economy by potentially increasing interest rates, and reducing the excess money supply.

While India's headline retail inflation has declined from its 15-month peak touched in July last year, it is still above the RBI's tolerance band of 2-6%. In December 2023, India saw its retail inflation rise to a four-month peak of 5.7%, up from 5.55% the previous month, primarily due to an increase in food prices, which climbed by 9.5% nationally.

The food price spike was sharper in the urban areas, surpassing 10%. Rural areas, while seeing a slightly less steep increase in food prices, endured higher overall inflation rates. Despite this uptick, the average inflation rate for the last quarter of the year was slightly below the RBI's forecast.

However, the government is confident that a slew of measures undertaken over the past months has helped reign in inflation. On February 7, Union Finance Minister Nirmala Sitharaman told the Rajya Sabha that the prices of various food items including that of essentials such as dal (pulses), atta (flour), and onions have started declining and are now well within the tolerance band.

First Published: Feb 8, 2024 10:28 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM