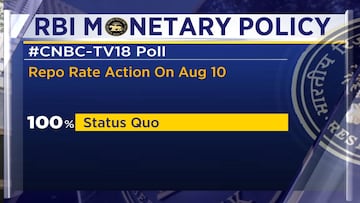

The Reserve Bank of India's Monetary Policy Committee (MPC) is holding a three-day meeting at a time when the nation is grappling with contrasting economic indicators. Market participants are eagerly awaiting the committee's decision, with a unanimous '

status quo' expectation dominating the sentiment, as indicated by a recent CNBC-TV18 poll.

Despite the ongoing turmoil in global economic waters, there is an air of cautious optimism surrounding the Indian economy. The recent surge in

vegetable prices, a matter of concern for households across the country, has been accompanied by a moderation in fuel and core inflation.

This unique blend of factors has given rise to a perplexing scenario, presenting the Reserve Bank of India (RBI) with a formidable challenge — how to chart a course amidst these contradictory signals?

The anticipation among market experts is palpable, with every respondent in the CNBC-TV18 poll predicting that the

RBI's MPC will opt to prolong the ongoing policy pause, keeping the repo rates untouched at 6.5 percent.

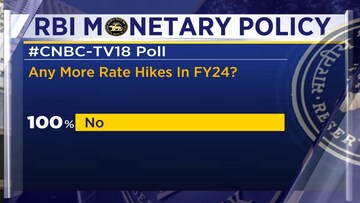

This resounding consensus further underscores the belief that the Indian financial landscape is unlikely to witness any further rate hikes throughout the remainder of the current financial year.

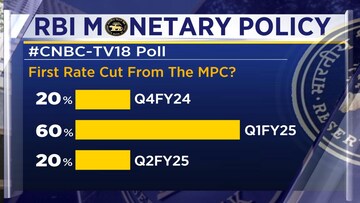

While the financial markets appear to have settled into this status quo, projections for the coming year paint an interesting picture. The prevailing sentiment suggests that the earliest rate cut might occur within the April to June quarter of the following financial year (FY25).

A significant 60 percent of respondents in the poll support this notion, with a few even speculating that the rate cut could manifest in the quarter immediately preceding or succeeding the expected timeframe.

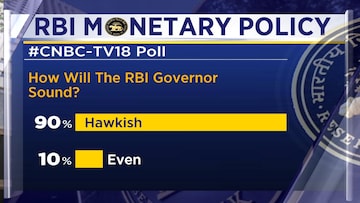

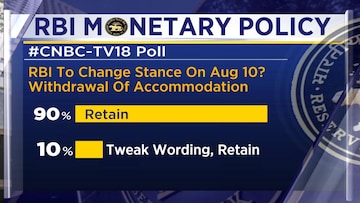

Beyond the rates themselves, the stance of the monetary policy is another area of intense scrutiny. Having persisted with a withdrawal of accommodation for over a year, market dynamics are aligned in anticipation of a consistent

policy stance, with expectations firmly placed on the status quo prevailing in this current policy review.

The spectre of inflation, however, looms large and continues to be a key concern for policymakers. The recent spike in food prices is expected to exert upward pressure on consumer inflation figures for the months ahead.

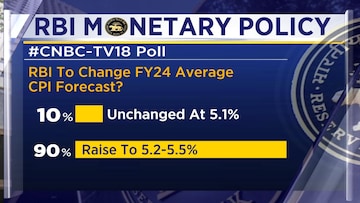

As a result, the previously projected

Consumer Price Index (CPI) inflation forecast of 5.1 percent for the full year is likely to experience a marginal revision, hovering within the range of 5.2 to 5.5 percent.

While inflationary forces wrestle for dominance, the outlook for economic growth remains comparatively stable. Forecasts for the year indicate that the RBI is likely to uphold its growth projections at 6.5 percent, maintaining a degree of consistency amid the turbulence of inflationary pressures.

For more details, watch the accompanying video