Home

Terms and Conditions

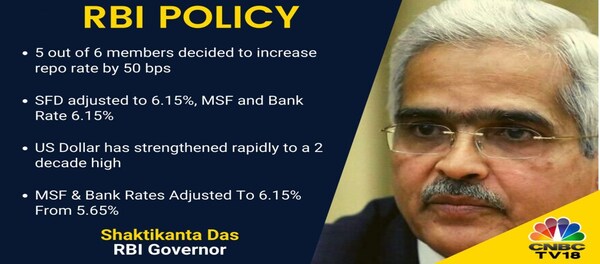

RBI Monetary Policy Highlights: RBI hikes repo rate by 50 bps — Shaktikanta Das says inflation remains persistently high

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live coverage on the RBI's bi-monthly policy review on September 30, 2022.

Stay tuned for other updates on our website: CNBCTV18.com

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Never been more bullish on banking: Prime Securities' N Jayakumar

N Jayakumar, MD at Prime Securities, tells CNBC-TV18 that he has not been more bullish on banking than over the last two years.

"Banking has been a leader of this rally and I think it will continue to do so,” he adds.

Future policy action to depend on inflation, external sector developments: CRISIL's Dharmakirti Joshi

Dharmakirti Joshi, Chief Economist at CRISIL, says that the future course of policy action will depend on the trajectory of domestic inflation, developments on the external sector and surprises in actions of other major central banks.

"The 50-basis-point hike was widely expected. It can be seen as a response to two issues: first, persistent risks to inflation, which has remained above the upper tolerance band for eight months now, and second, spillover risks from the aggressive monetary policy stance of major central banks, especially the Fed." he says.

No real surprise on policy rate front or even forecasts: Madan Sabnavis on RBI policy

Madan Sabnavis, Chief Economist of Bank of Baroda, says the RBI policy is along expected lines with no real surprise on the policy rate and forecast fronts. "The lower GDP forecast is more due to statistical aberrations as their Q2, Q3 and Q4 forecasts have been revised upwards," he tells CNBCTV18.com.

"Given the focus on global trends, it appears that we can expect another 50-60 bps hike in course of the year... One positive observation is the RBI has said that two-thirds of the decline in reserves is due to valuation which means the central bank has not been spending reserves to protect the rupee!" he adds. (What other economists say)

Inflation may ease a bit but wheat prices may remain high

The RBI retains its retail inflation projection at 6.7 percent for the financial year ending March 2023. While there is no change in the estimate, governor Shaktikanta Das warns of a possible rise in prices of wheat and vegetables. (Read more)

India's economic activity remains stable against challenging global environment: Shaktikanta Das

RBI Governor Shaktikanta Das points out that while real GDP growth in the June quarter turned out to be lower than the central bank's expectations, a late recovery in kharif sowing, comfortable reservoir levels, improvement in capacity utilisation, buoyant bank credit expansion and the government’s continued thrust on capex are expected to support aggregate demand and output in the six months ending March 2023.

Liquidity to probably improve in coming months: Kotak Mahindra Bank's Upasna Bharadwaj

Upasna Bharadwaj, Senior Economist at Kotak Mahindra Bank, tells CNBC-TV18 that liquidity will probably improve ini the coming months as the government is expected to start to spend. "But if we look at the core liquidity, the durable liquidity that is around Rs 3-3.5 lakh crore, and that is probably one aspect where we need to keep in mind... The accommodation still remains and once that is approaching zero or neutral territory, that is where the overall system-wide we will get a policy stance that will be neutral," she says.

"I think that's where the convergence will happen. And we do expect that the liquidity will tighten going ahead... Durable liquidity, moving more towards neutrality by the end of the year... largely because the currency leakage will be offsetting the government spending,” Bharadwaj adds.

RBI to stop 28-day variable rate reverse repo auctions, to continue with 14-day ones

The RBI decides to stop conducting 28-day variable rate reverse repo (VRRR) auctions, citing the current banking system liquidity conditions. It, however, will continue with the 14-day auctions.

"Fine-tuning operations of various maturities will be conducted for injection as well as absorption of liquidity as may be necessary from time to time," says the RBI governor.

The move comes as the country's banking system liquidity slipped into a deficit earlier this month. It has largely remained the same since then.

The deficit stands at Rs 18,700 crore ($2.3 billion). (Read more)

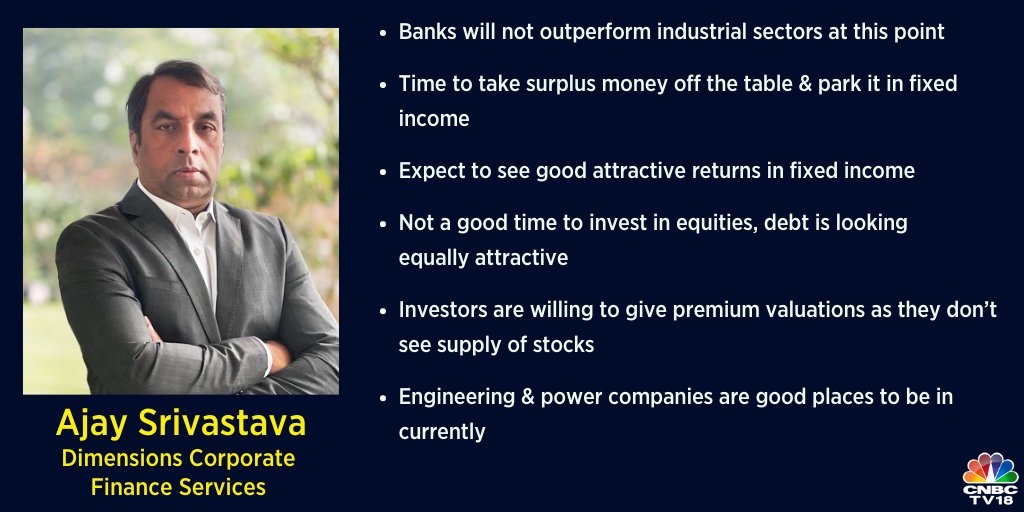

Credit policy tailor-made for banks: Dimensions Corp's Ajay Srivastava

Ajay Srivastava, CEO of Dimensions Corporate Finance Services, says in an interaction with CNBC-TV18 that the September 30 RBI policy has reinforced that the credit policy is tailor-made for the bank. "That's the beauty of the whole thing because the interest rates go up, bank earnings go up by tonight but the savers still get disappointed because their rate increase is not visible... Because the RBI is still keeping the policy saying 'I will have enough liquidity for you guys not to get troubled'. It's not saying anywhere that 'I'm going to take away your liquidity so that you are forced to give savers a positive rate of interest'," he says.

"The 4 percent NIM that most private banks enjoy continues to be so called guaranteed by the RBI... The policy has failed. There's no doubt that it's hit consumption, the index is where it is, thanks to global... thanks to consumption in India, which is not the brightest... September has not been a very bright month, as you will see the first indicators come out, we've been monitoring it, it is not a good month," he adds.

RBI policy exactly in line with expectations with no surprises: R Sivakumar

R Sivakumar, Head-Fixed Income at Axis Mutual Fund, tells CNBC-TV18 that in his view, the reason why the market reaction has been relatively muted is because the latest RBI policy is along expected lines. "I would expect the same to continue unless we get some dramatic new developments. Now, a fair amount of future rate hikes are also priced in. So in that sense, at least for the near term, we should expect relative stability," he says.

"Relative stability means plus or minus 10 or 20 basis points in a month is not really, really a surprise, as we have seen in the last few months. But we should expect relative stability and no major biases. We really don't expect any major bias certainly to the upside at this point in time," he adds.

Banks to do some tweaking in coming days: SBI's Alok Kumar Choudhary on deposit rates

Alok Kumar Choudhary, MD-Retail Business and Operations at State Bank of India, says that as of now, the rate of deposit growth is almost 9.5 percent and advances growth at 16.2 percent.

"There is already some kind of pressure on deposits so banks, as per their asset liability mismatches and their growth prospects in credit... They will do some tweaking in the coming days,” he adds.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|