After Reserve Bank of India's (RBI) two-day monetary policy (MPC) meeting, Governor Shaktikanta Das announced the policy decisions on August 10. RBI has kept the real GDP forecast for FY24 unchanged at 6.5 percent on the back of higher rural and urban growth, increased investment activity and government's plan of higher capital expenditure.

Das also added that India is positioned to weather the external headwinds far better than other economies.

"India’s strong macroeconomic fundamentals have led to strong growth, India is contributing approx 15 percent to global growth," said Das.

Last month, RBI announced that India's forex reserves has seen the biggest weekly jump in four months, as they went up by $12.74 billion to $609.02 billion. Previously, forex reserves had witnessed an uptick of $1.23 billion for the week ending on July 7.

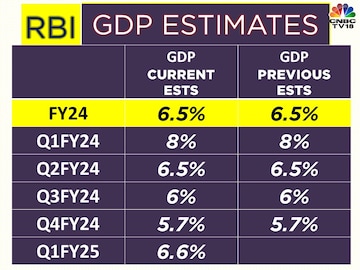

In the MPC briefing Das mentioned that the risks for GDP are evenly balanced but the the protracted geo political tensions pose downside risk to the growth. For Q1FY24 the GDP is estimated to be a at 8 percent, the estimate is 6.5 percent for Q2FY24, 6 percent for Q3FY24 and 5.7 percent for Q4FY24.

Meanwhile the GDP forecast for Q1FY25 is estimated to be at 6.6 percent.

Das also said that Level of surplus liquidity has gone up due to withdrawal of Rs 2000 banknotes, and dividend to government, said governor Saktikanta Das. CNBC-TV18 recently reported that over 72 percent, that is Rs 2.62 lakh crore worth of these high denomination currency notes have been either exchanged or deposited in banks.

Rajiv Anand, Executive Director at Axis Bank said that "This is a move basically to immunize the money that came in because of the Rs 2000 action that RBI took. Our own rough and ready estimate is that the total impact to the banking system is about Rs 1 lakh crore for this brief period in the context of the fact that there is Rs 2.5 lakh crores of surplus liquidity. I think the impact whether it is on net interest margins (NIMs) or on profits is really minimal. Because it is just for a period of a month. So, I don't think the impact is going to be material at all. Secondly, I think the underlying growth continues to be strong, credit demand continues to be strong. I think what we have to work through is the continued fight for deposits, and that really is going to be the theme for the rest of the year,"

First Published: Aug 10, 2023 10:17 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM