The monetary policy is 'dangerously close' to levels at which it can inflict significant damage to the economy, said Professor Jayanth R Varma in the Reserve Bank of India (RBI) Monetary Policy Committee (MPC) minutes released on Thursday, June 22. Varma highlighted that "based on the forecast inflation for 5.1 percent for 2023-24, the real repo rate is now almost 1½ percent.” “Despite this, the majority of the MPC wishes to remain focused on withdrawal of accommodation whatever that phrase might mean,” Varma said.

The RBI MPC member, who has expressed his reservations on the continuation of the policy stance in the June 6-8 meeting, pointed out that MPC's stance is becoming more and more disconnected from reality.

Continuing to criticise the continuation of policy stance, Varma said, "Turning to the stance, I find that with every successive meeting, this stance is becoming more and more disconnected from reality. Based on the forecast

inflation for 5.1 percent for 2023-24, the real repo rate is now almost 1.5 percent. (The real short-term rate could well be above that level since in recent weeks, many money market rates have often drifted towards the MSF rate of 6.75 percent)."

The RBI MPC member, however, did not mark a dissent on this terming the stance vestigial at this juncture, as per the minutes.

"I have therefore seriously considered dissenting on this part of the resolution, but after careful thought I have decided to confine myself to expressing reservations on it. The main reason for not dissenting is that, after two successive meetings at which the repo rate has been left unchanged, this stance now appears more vestigial than a serious statement of intent," Varma wrote in the minutes.

Inflation and growth outlook

The RBI MPC member said that the outlook on inflation and growth has changed only marginally between April and June's meeting. The two inflationary risks that Varma spoke about in April — crude prices and the monsoon — have become a little less worrisome, he said.

On the crude oil front, Varma said it is now clear that OPEC+ is struggling to reduce supply adequately to counter sluggish demand, and the risk of a substantial spike in crude price in the near term is not very high. On monsoon, he said the official forecast of a normal monsoon provides some comfort, but it is tempered by the fact that the forecast includes an almost even chance of monsoon being below normal or worse.

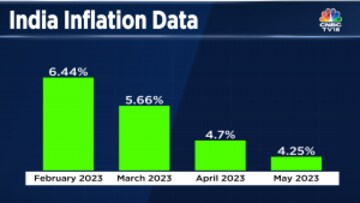

Another indication of a slight reduction in inflationary risks, as per Varma, is the slight decline in the RBI projections of inflation for 2023-24 between the April and June meetings.

Similarly, the outlook for growth remains more or less the same as in April with several high frequency indicators suggesting that growth is not as robust as we would like.

Considering the balance of risks, Varma said that he voted for keeping the repo rate unchanged in june's meeting. "I am of the view that the current level of the repo rate is high enough to keep inflation below the upper tolerance band on a sustained basis and also glide it towards the middle of the band," he said.

Varma, however, noted that there are significant risks to both inflation and growth, and the process of bringing inflation under control is still very much work in progress. He also said that it would be premature to declare victory at this point of time based on the inflation prints of just a couple of months.

The RBI left the main policy instrument, the repo rate, unchanged at 6.50 percent for the second consecutive monetary policy meeting on June 8, 2023.

The decision to keep the repo rate — the interest rate at which the central bank lends to banks — unchanged was taken unanimously by the six MPC members as inflation continues to remain above the 4 percent target. The RBI has been mandated by the Central government to keep consumer price index-based inflation (CPI) at 4 percent with a band of +/- 2 percent.

In a 5:1 majority, the RBI's rate-setting panel also decided to remain focused on withdrawal of accommodation. In the April 2023 policy, the central bank had paused its rate hike cycle after raising the key lending rate for six consecutive times since May last year.

(Edited by : Shoma Bhattacharjee)

First Published: Jun 22, 2023 5:40 PM IST