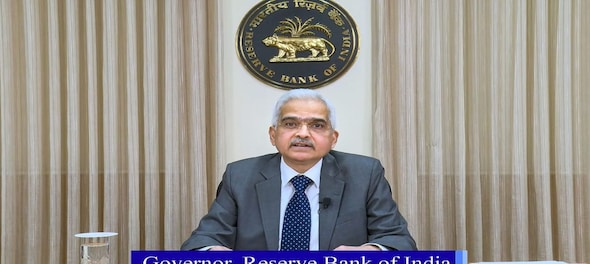

The Reserve Bank of India (RBI) will announce its monetary policy outcome on December 8, Friday. A poll by CNBC-TV18 predicts that the central bank will likely keep the repo rate unchanged in its upcoming review.

This time, what the markets are really interested in isn't the interest rates or the overall approach, as those are expected to stay the same given the current situation. Instead, people are eagerly waiting to see if the governor will make any surprising announcements, including increasing risk weights or selling bonds in the open market.

All the respondents of the CNBC-TV18 poll expect no changes in the repo rate this time. This has been the policy for the fifth consecutive time, mainly because of better-than-expected economic growth and ongoing uncertainty about inflation.

According to the survey, most participants don't anticipate any more rate hikes in this fiscal year. As for the first rate cut, 20% expect it in the first quarter of the next fiscal year, while almost 70% expect it only in the second half of FY25.

There's no expected change in the policy stance, which is expected to remain at the withdrawal of accommodation. There's not even a hint of a possible change in stance, as many believe it will be challenging for the Monetary Policy Committee (MPC) members to reach a consensus on shifting to a neutral stance just yet.

Read Here | Experts caution ahead of RBI Monetary Policy: Weak growth, dual-paced economy, food inflation raise concerns

The predicted inflation rate for FY24 at 5.4% is likely to remain the same, with only 10% expecting a slight upward revision. On GDP numbers, most expect the RBI to increase the forecast for the year to between 6.6% and 6.9% based on a stronger-than-expected performance in the second quarter.

The governor is expected to express a more cautious outlook in his statement, leaning towards being hawkish rather than dovish. This is because concerns about inflation persist, and there are still risks to the economy.

In terms of liquidity-related measures, some expect clarification on the announced OMO bond sales. There's also anticipation for any changes in the standing deposit facility mechanism, which could tighten policy without adjusting rates. Others are looking for short-term announcements related to liquidity.

Regarding prudential measures, there's a general expectation that the RBI might make adjustments where it sees excesses, similar to what it did for unsecured loans. There could be more standardisation of risk weights. The governor has previously warned about high lending rates from certain microfinance lenders, so the markets will be watching for any regulatory actions in that area. However, these changes may not necessarily happen in this policy announcement.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Manoj Tiwari richest contender in Delhi, party's Bidhuri is second

May 7, 2024 7:37 AM

Lok Sabha Election 2024 Phase 3: Voting on in 93 seats, fate of Shah, Scindia, Chouhan to be sealed

May 7, 2024 7:04 AM