RBI Governor Shaktikanta Das has announced that the Indian central bank will not hike its lending rate (repo rate) contrary to what market watchers and economists were expecting. A CNBC-TV18 poll had seen 90 percent of economists predict a 25 bps rate hike. Thus, the lending rate stands at 6.5 percent as announced on Feb 8 in the previous policy.

Governor Das reasoned that the global economy has seen an uptick in recent times, as well as inflation, has started to moderate.

"The headline inflation is expected to moderate in 2023-2024. MPC will not hesitate to take further action in future meets," mentioned Das.

The Monetary Policy Committee also voted by a 5:6 majority to remain focussed on the withdrawal of accommodation to ensure inflation aligns with the target while focussing on growth.

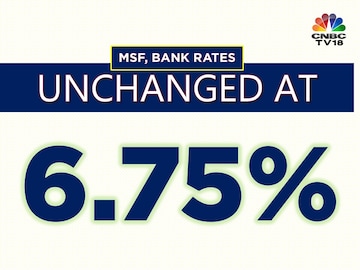

The standing deposit facility (SDF) rate is unchanged at 6.25 percent. Moreover, the marginal standing facility (MSF) and bank rates have also been left unchanged.

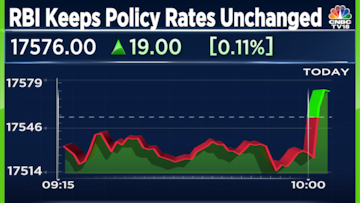

The market has reacted positively to this news and as seen in the graph below recovered from its lows. At the time of publishing the Nifty50 has turned positive and is 30 points in the green.

"The RBI will adopt a nuanced approach to liquidity management. Will ensure completion of government borrowing programme in a non-disruptive manner," said the Governor.

For the current financial year, which started just a few days back, the RBI Governor projected a growth rate (GDP) of 6.5 percent. For the same period, the

inflation projection has been kept at 5.2 percent.

Catch LIVE updates on RBI's MPC Meet, reactions and more here First Published: Apr 6, 2023 10:11 AM IST