The Reserve Bank of India (RBI), in the Monetary Policy Committee’s (MPC’s) statement on Friday, increased the policy repo interest rate — at which it lends short-term money to banks — by 50 basis points to 5.4 percent, withdrawing its accommodative stance.

The central bank's rate hike, the third in the current financial year, came in a bid to tame the inflationary pressure and protect against further rupee depreciation.

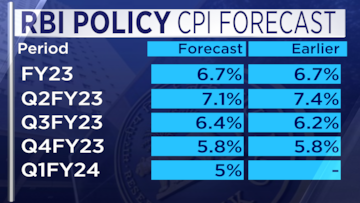

The RBI retained its retail inflation forecast for the current financial year at 6.7 percent. In its earlier policy review in June, the central bank had forecast Consumer Price Index (CPI) inflation would average 6.7 percent in 2022-23.

"Headline inflation has recently flattened, and the supply outlook is improving, helped by some easing of global supply constraints. The MPC, however, noted that inflation is projected to remain above the upper tolerance level of 6 percent through the first three quarters of 2022-23, entailing the risk of destabilising inflation expectations and triggering second-round effects," the committee noted in its statement.

The bi-monthly meeting of the RBI MPC started on Wednesday, and RBI Governor Shaktikanta Das announced on Friday that the MPC unanimously decided to hike the policy rate.

First Published: Aug 5, 2022 10:30 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM