Home

Terms and Conditions

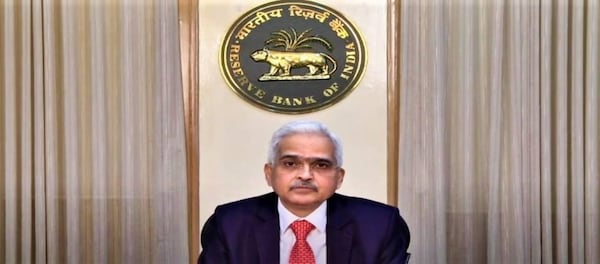

RBI Monetary Policy Highlights: Governor Shaktikanta Das says inflation remains at uncomfortably high levels

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live coverage on the RBI's bi-monthly policy review on August 5, 2022.

Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

RBI action to lead to improved, faster resolution to issues faced with CICs by retail borrowers: ICRA's Anil Gupta

Anil Gupta, Vice President and Co-Group Head-Financial Sector Ratings at ICRA, said credit bureau scores have been highly instrumental in lending decisions and improved access to credit for retail borrowers.

"The credit availability and the borrowing costs are also influenced by the credit score of the borrowers. With inclusion of CICs in the ombudsman scheme, the retail borrowers could expect an improved, faster, and transparent resolution of their issues faced with the CICs," he adds.

Quantum of rate hike on upper end of market expectation: Ajmera Realty CFO

Nitin Bavisi, CFO of Ajmera Realty and Infra India, believes the quantum of the rate hike was on the upper end of market expectations. The RBI's move to retain its GDP estimate for the year ending March 2023 illustrates the relatively strong macro fundamentals of the economy compared with advanced economies, he said.

"From the current perspective of real estate developers, input costs will continue to receive inflationary pressure in the medium term. Even after taking today’s rate revision into account, revised home loans are still expected to remain marginally lower than pre-pandemic levels which augur well in sustaining the demand momentum for the residential sector," he added.

Domestic inflation appears to have peaked out: Indian Bank CEO

Shanti Lal Jain, MD and CEO of Indian Bank, is of the view that inflation in the country appears to have peaked out.

"Through this policy, RBI has brought in several measures to maintain price stability while keeping in mind the objective of growth... It has already started to tighten liquidity in the system along with withdrawal of accommodative stance in a calibrated manner... By enabling the cross border inward bill payment system, the ease and convenience of the NRIs will improve along with forex inflows," he says.

Surendra Hiranandani, Chairman and Managing Director, House of Hiranandani reacts on RBI's Monetary Policy

"The increase in repo rates will have an effect on interest rates as well as homebuyer attitude. This year has seen a steady increase in home sales, but the ongoing climb in mortgage rates may overwhelm a buyer."

NRIs can pay now pay for bills in India directly

The Reserve Bank of India has enabled Non-Resident Indians (NRI) to pay bills in India directly. Now cross-border inward payments. through Bharat Bill payment system (BBPS) has been enabled. Earlier, payments through BBPS were only available to customers in India. READ MORE

Kalpesh Dave, Head Corporate Planning & Strategy, Star HFL reacts on today's RBI Monetary Policy.

“HFCs/NBFCs should brace for higher borrowing costs on new credit lines. The same goes for home loan customers. It makes sense to switch to fixed rate offerings post evaluating the benefits that can be incurred.”

Adhil Shetty, CEO, BankBazaar.com explains factors home loan borrowers should consider after RBI hikes repo rate by 50 bps

The question borrowers may ask now is if their home loan rate is too high. One of the ways you as a borrower can evaluate this is by checking the premium you are paying above the repo rate. If you are a prime borrower (credit score over 750, stable income, loan payments on time), you can get home loan offers at a premium of around 250-275 basis points over the repo rate, which is now 5.40. So basis the rates we’ve seen in recent months, the lowest rate at which you can get a home loan now may be in the 7.9 to 8.15 range.

The range could be lower or higher depending on who you are and whom you are borrowing from. If you're already in that zone, you may focus on pre-paying and voluntarily paying a higher EMI to control your ballooning interest. If you’re beyond this comfort zone, you may also want to consider a refinance with your own lender or with another one offering you better terms.

New borrowers especially need to be careful. They borrowed at rock-bottom rates of 6.50 to 7.50 in the last two years. Their loan tenors may increase substantially as their rates rise. In floating rate loans, EMIs remain constant and it’s normally the tenor that adjusts for the rate change. For example, a Rs. 30 lakh loan at 6.50 for 20 years will have an EMI of Rs. 22,367. But at the same EMI at an 8.00 rate, the tenor increases to 28 years and 6 months. This can interfere with other financial plans such as investing for retirement or children’s education.

Rajni Thakur, Chief Economist, RBL Bank reacts on RBI MPC decision

“The markets had broadly priced in 50 bps hikes in Repo rates and any forward guidance would have mattered more than the rate action itself. The policy statement however, stayed away from any explicit forward guidance while remaining consistent on its assessment of growth and inflation trajectory for the economy. Any mention of nature and quantum of intervention, to manage currency faced with huge capital outflows didn’t find a place as well. Nevertheless, given the growth-inflation outlook, further hikes towards 6% terminal repo rate seem imminent, even though the pace of hike will likely be softer going ahead. Continued ‘focus on withdrawal’ indicates further drawdown of excess liquidity as well, in which case, monetary tightening is far from over yet”.

Madhavi Arora, Emkay Global reacts to RBI MPC decision

"The tone was balanced and similar to June, aiming to tame inflation and external risks. We maintain that FY23 could see RBI’s policy rates terminating around 5.75%-5.90%, with the central bank showing its intent to keep real rates near the estimated natural rate. The need for terminal rates to go too higher than that seems low to us at this point."

Amar Ambani, Head - Institutional Equities Head, YES SECURITIES reacts on RBI rate hike

"We see RBI delivering yet another rate hike, probably a mild one (25bps) in October to ensure that price pressure remains under control before it peaks during Q3 FY23. We see the repo rate peaking around 5.7-6.0%.”

Home buyer affordability shrinks; developers may adopt mitigating measures, says Shishir Baijal, Chairman and MD, Knight Frank India

“For the real estate sector specifically, the third subsequent rate rise will mean a deterioration of affordability and may impact the sentiments of home buyers. With the cumulative rate hike until today, assuming complete transmission, a prospective home buyers’ affordability shrinks by around 11% i.e. from an ability of purchasing a house of Rs.1 crore value shrinking to Rs. 89 lacs now. Developers are expected to undertake mitigating measures to soften the blow on homebuyer affordability.”

There are signs that CPI has peaked, it's expected to moderate in Q4FY23 and Q1FY24. Inflation still remains at uncomfortably high levels, says RBI Governor Shaktikanta Das

Arun Kumar, Head of Research, FundsIndia reacts on RBI MPC decision

"We expect the pace and quantum of rate hikes to moderate going forward, led by falling commodity prices, global growth concerns, and easing global supply constraints. In our view, the bond yields, especially in the 3-5 year segment, discount a large part of the expected rate hikes.”

RBI Governor Shaktikanta Das addresses the media: Key highlights from his interaction

-Forex reserves remain strong

-Monetary policy will be calibrated, measured & nimble

-Inflation remains at 7%

-Other central banks, today, a 50 bps rate hike is normal

-Many central bankers are hiking by 75-100 bps too

-Impact of past rate hikes has been factored into inflation forecast

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|