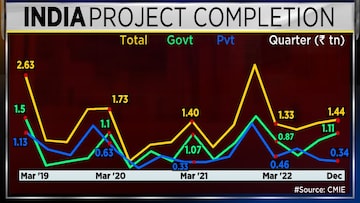

India's capex appears to be picking up, going by recently announced data from Centre for Monitoring Indian Economy (CMIE). CMIE’s latest data shows new project announcements in the October-December quarter rose by 44 percent over the previous quarter. This was led by private sector investments as they have doubled quarter on quarter (QoQ), even if we take full 9-months, April to December, CMIE data shows that new project announcements grew by 35 percent over the same period previous year.

Private sector investment in India has increased, largely due to government initiatives, according to Mahesh Vyas, Managing Director, and CEO of CMIE. Speaking on CNBC-TV18, Vyas said that the government's spending has been evident in the capex database. Despite this, Vyas expressed anxieties about the pick-up in private sector proposals.

india new investments

“The government is spending and that is seen partly in the capex database by CMIE, which shows that completions by government is higher than private sector,” said Vyas.

Subodh Rai, President and Chief Ratings Officer at CRISIL Ratings, also spoke on CNBC-TV18 about the green shoots seen in private capex, particularly in the infra sector thanks to the government's PLI scheme. Rai said that new project announcements grew by 35 percent over the previous year to Rs 14.8 trillion from April to December.

“Between FY23 and FY25, roughly Rs 15 lakh crore per annum capex will happen. The second element which is giving a fillip to the capex is PLI scheme. Our expectation is between FY23 and FY26, roughly Rs 2-2.5 lakh incremental capex will happen,” said Rai.

However, Vyas noted that there has been a significant delay in the completion of projects, with only Rs 7 lakh crore expected to be completed this year, compared to the expectation of Rs 10 lakh crore.

Rai added that, compared to the pre-COVID period, capex is expected to rise by 30 percent in FY24, with banks being well capitalised to aid in private sector investments. There are also reports of capex from steel and auto players.

For the entire discussion, watch the accompanying video.

First Published: Jan 10, 2023 1:42 PM IST

india new investments

india new investments