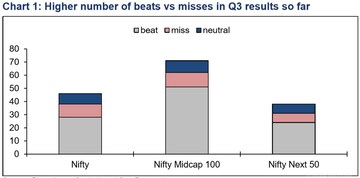

The corporate earnings in the third quarter of fiscal 2021 have been strong with a beat/miss ratio of 4.3x. Pent-up demand, driven by the pandemic impacted economy slowly and steadily looking to regain momentum along with the festive season, which is definitely playing a bigger role in boosting demand and double-digit volume growth such as construction, manufacturing and selectively consumption resulting in a strong earnings season.

Telecom revenue growth was strong for market leaders at more than 20 percent, while utilities showed moderate growth of less than 10 percent. Domestic pharma sales ranged from moderate to strong between 5-25 percent, YoY, according to a report by ICICI Securities.

Source: ICICI Securities

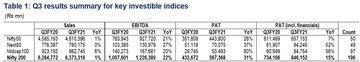

Source: ICICI SecuritiesHowever, demand was negatively impacted by volume contraction in discretionary consumption such as retail, leisure, travel & restaurants and selectively in manufacturing (regional cement manufacturing and power - capital goods).

Exports picture improved with merchandise exports showing improvement (auto, ceramics, chemicals) while IT services were steady; US pharma exports, however, were subdued, the report said.

Meanwhile, rising prices helped realisations for metal and cement sectors while helping in inventory gains for oil companies.

Source: ICICI Securities

Source: ICICI SecuritiesMargins largely augmented by ‘cost control’ and product mix even as input prices continued to put pressure on gross margins in general. This phenomenon is continuing in Q4FY21 as evidenced by further rise in 'manufacturing inflation' component within WPI to 5 percent largely driven by metal prices, the report noted.

Selectively, financials posted robust operating performance indicating pockets of improving demand for credit in the system although some intermediaries had weak growth and showed higher than expected credit cost and NPAs. PAT outcome is much better than consensus expectation for third quarter in a row, indicating a systematic scepticism on the earnings upgrade cycle, the brokerage said.

Source: ICICI Securities

Source: ICICI SecuritiesICICI Securities is of the view that the discretionary consumption such as retail and leisure which continue to contract, will see incremental pent-up demand getting released as Covid cases recede, which is evidenced by their mobility trends.

Robust high-frequency data for Q4FY21 so far, such as PMI and GST collections, indicates that recovery is extending beyond the festive season and does indicate signs of sustainability of demand both for manufacturing and services, the report noted.

Overall, the brokerage believes that the environment is turning favourable in terms of a countercyclical fiscal policy with a focus on capex, pro-growth oriented policies, lower interest rates, ample liquidity and optimism around a fully-operational economy as Covid cases recede.

Above environment is conducive for driving the ‘invisible hand’ which could boost aggregate demand from ‘private sector and households’ sustainably beyond the pent-up demand seen in Q3FY21, it said.

Rolling forward earnings to FY23 EPS and assigning bull market valuations of ~20x P/E, ICICI Securities’ target for the NIFTY50 is 16,300.

Read all earnings here.

(Edited by : Jomy)

First Published: Feb 18, 2021 3:39 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM