Employers and others assisting patients with COVID-19 treatment bills will get tax exemptions, the Centre said on Friday. The Finance Ministry said any amount spent by anyone for the treatment of an employee or someone else would be free from taxation.

In simple terms, the person who pays for the treatment and the beneficiary of the payment will not face tax liability. The move has brought relief to a lot of people burdened by medical expenses.

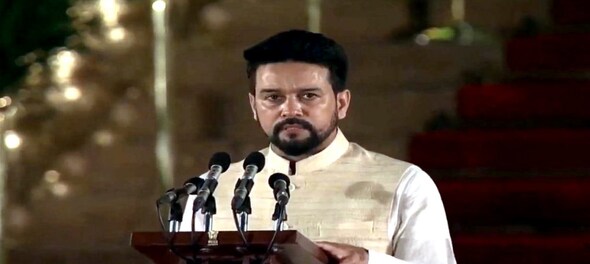

Anurag Thakur, MoS, Finance, said, “Amount paid for treatment of an employee by an employer or to any another person in 2019-20 and subsequent will not be taxed.”

Important announcements related to @IncomeTaxIndia✅We are announcing impt measures related to Tax Concessions for Payment towards COVID Treatment/Death.✅Easing of IT Compliance Burden during COVID.✅And additional Relief Measures for Income Tax Payers have been taken. pic.twitter.com/NxqsOJRa0Y

— Anurag Thakur (@ianuragthakur) June 25, 2021

An exemption has also been extended to the family members of individuals who died due to COVID-19. Any amount received by the family from the deceased individual’s employer will not be taxed. However, if they have received financial assistance from other people, the exemption will be capped at Rs 10 lakh.

The Central Board of Direct Taxes (CBDT) has extended several timelines related to income tax in view of the disruptions caused by the pandemic.

“Relief is being provided through extensions of the following deadlines as a measure to ease taxpayer compliances during the pandemic period,” tweeted Union Finance Minister Nirmala Sitharaman.

The deadline for linking Aadhaar with PAN has been extended to September 30 from its earlier deadline of June 30.

Salaried employees will face a delay in getting their Form 16, which is necessary for filing I-T returns, and they will be given 15 days extra to complete the process. The new deadline is July 15.

The CBDT has also relaxed the deadlines for uploading Forms 15G/H for the quarter ended June 30, 2021, to August 31.