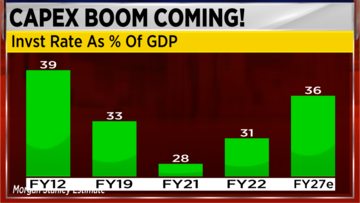

Morgan Stanley is expecting a capex boom in the Indian market. It expects India’s investment rate — or the percentage of GDP that is invested — to rise to 36 percent of GDP. Last year’s investment was at 31 percent and at 36 percent it would be the highest since FY12-13.

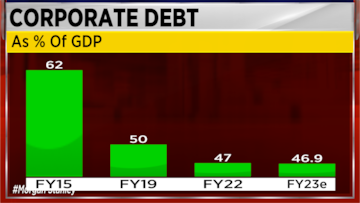

Why does the brokerage firm see a capex boom? One, the balance sheets of companies and banks are at their best in a decade. Two, corporate debt to GDP is the lowest in 15 years; bank NPAs are at their lowest in 10 years.

From the demand side, companies are running out of capacity; capacity utilisation is running at 75.3 percent, which is higher than the 10-year average.

Government policies like PLI and corporate tax cuts are things for the private sector to do capex, while the government's capital expenditure, in the FY23 budget, stands at 2.9 percent of GDP — this year is the highest in 18 years.

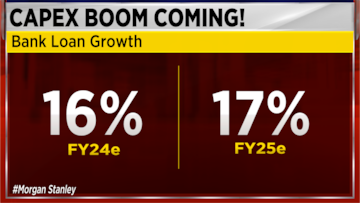

Thanks to the capex boom, Morgan Stanley expects bank loan growth to rise to 16 percent next year and to 17 percent in FY25.

It also expects higher investments to kick start a virtuous cycle of higher profits which can, in turn, lead to higher investments, wages and consumption.

Typically corporate profits as a percentage of GDP rise during such a capex boom, and Morgan Stanley expects corporate profits to grow at a CAGR of 25 percent for the next four years, which means the current 20x valuation is not expensive.

The risks to this forecast are if the global economy slips into a recession or if there is a spike in commodity prices due to war or some supply-side issues, there could be higher rates and tight financial conditions.

Upasana Chachra, Chief India Economist at Morgan Stanley, told CNBC-TV18 that rural demand has been weak to range bound, adding that the reopening effect of the economy should improve support for unorganised and informal sectors.

“What we think will support the rural sector, and probably it should start getting reflected now, is that the whole reopening effect of the economy, which will support and should improve the support for the informal or the unorganised sectors, which have not really participated in the recovery till now,” she said.

Talking about exports, she said Morgan Stanley expects an improvement in India’s goods export market share.

“We see an improvement in India's goods export market share. Goods export market share is currently tracking near all-time highs of about 1.9 percent. It was at the low point around 1.5-1.6 percent and pre-pandemic, it was around 1.7-1.8 percent range. So we see some amount of offset through export market share gains, and the story should continue,” Chachra said.

For the entire interview, watch the accompanying video