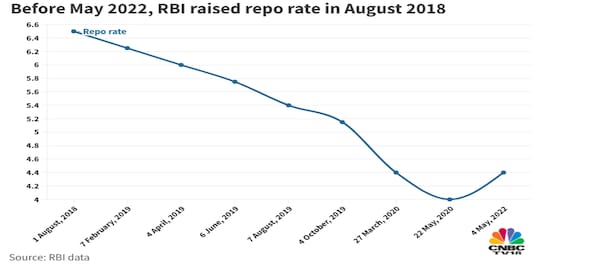

Given the spectre of higher inflation, the Monetary Policy Committee (MPC) presciently increased the policy repo rate by 40 basis points (bps) in an off-cycle meeting in May. It decided to remain accommodative while focusing on withdrawal of accommodation to ensure inflation remains within the target while supporting growth. It also raised the cash reserve ratio (CRR) by 50 bps to 4.50 percent to absorb surplus systemic liquidity of around Rs 87,000 crore.

With the June 2022 policy meeting starting on Monday, we expect another 40 bps hike in the repo rate, an upward revision in the inflation forecast for FY23, and no changes in the growth forecast or the CRR.

The CPI inflation surged to a 95-month high of 7.8 percent in April 2022, with a clear broad-basing of inflationary pressures. Despite the measures taken by the Indian government, such as the excise cut on fuels, ban on wheat exports etc., we expect the CPI inflation to average around 6.5 percent in FY23, much higher than the MPC’s April 2022 projection of 5.7 percent. This is led by global supply-side disruptions for food and non-food items, the renewed rise in global commodity prices, and the anticipated strengthening in the domestic demand for services.

Accordingly, an upward revision in the MPC’s FY23 inflation forecast is inevitable. Additionally, there is a high likelihood that the monthly CPI inflation prints will remain northwards of 6 percent, i.e. the upper limit of the MPC’s medium-term forecast range of 2-6 percent, for most of the months of FY23.

Also Read:

On the growth front, the pace of India’s GDP expansion expectedly eased to 4.1 percent from 5.4 percent in the third quarter of FY22. A recovery in demand for contact-intensive services and better income visibility for households dependent on the same, as well as some signs of an uneven revival in capex will support the growth momentum in FY23.

Nevertheless, business margins are likely to be squeezed, amid an incomplete pass-through of input price pressures, while higher inflation would constrain demand growth. Moreover, external demand is set to weaken amid the ongoing geopolitical tensions, elevated commodity prices, and policy tightening across advanced economies.

Following the real GDP growth of 8.7 percent in FY22, on the subdued base of the pandemic-hit FY21, we maintain our forecast of an expansion of 7.2 percent in FY23. This is in line with the MPC’s April 2022 projections.

With the average FY23 CPI inflation expected to be well above the upper limit of the MPC’s medium-term forecast range, we anticipate that the MPC will increase the repo rate by 40 bps in the June 2022 review. This is likely to be followed by further hikes of 35 bps each in the August 2022 and September 2022 reviews, taking the benchmark policy rate to 5.5 percent. After this, we foresee a pause to assess the underlying economic growth momentum being displayed by the Indian economy.

The rise in global interest rates and domestic monetary tightening will lead to a hardening in government bond yields in the next few months. We suspect the yield of the 10-year Government of India security (G-sec) will test 8.0 percent by the end of September 2022, up from around 7.45 percent at present.

Moreover, deposit rates of banks have started inching up, following last month’s repo hike. If the small savings rates are reset at the end of this month, it may prevent the market borrowing programme of the Indian government from having to be enlarged substantially, amid some concerns of a modest fiscal slippage, thereby preventing a faster rise in the G-sec yields.

—Aditi Nayar is Chief Economist, ICRA. Views expressed are personal

(Edited by : Ajay Vaishnav)

First Published: Jun 6, 2022 8:52 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM