Three years on, some of them like the privatisation of some significant government companies, a development finance bank dedicated to expediting infrastructure projects and, separately, a new asset reconstruction company that would deal with the bad loans in the system, are still among the Modi administration’s probable unfinished business. There has been limited tangible progress in the centrepiece of the Modi government’s economic idea, the privatisation of government-owned entities.

In the budget for the financial year ending March 2022, the Finance Minister said two public sector banks and a general insurance company would be sold to private investors. Going into FY25, all three are on the pending list. The apparent reluctance of the government can also be explained by the persistent financial distress of state-owned general insurers. In such a situation, the government may not be able to extract a good price for its stake from the market.

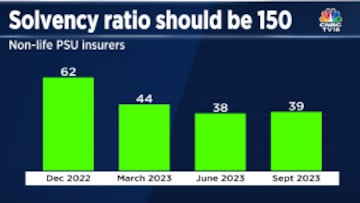

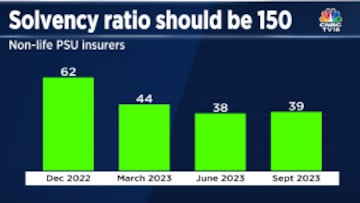

The RBI’s Financial Stability Report said that the government-owned general insurance companies are well short the required solvency ratio, which shows the financial health of these copmanies.

The market continues to wait for the proposed stake sale by the government in high-profile companies in Container Corporation of India and the privatisation of Shipping Corporation and BEML. The government is still committed to selling IDBI Bank to private investors. It’s the only plan from the various disinvestment announcements since 2019 that may still go through, even if slowly and quietly. These disinvestments are important to the government for not just funding its welfare schemes but to also help deliver on its promise of “minimum presence, maximum governance”

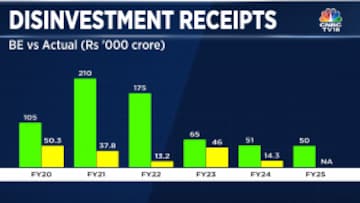

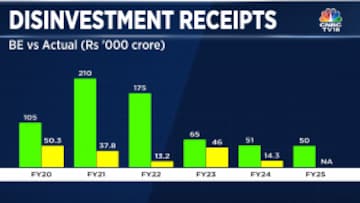

However, the lack of grand proclamations or ambitious targets in the FY25 budget is a sign that the government isn’t as gung ho about disinvestment as it used to be three years ago.

BE stands for budget estimate

Money for infrastructure

While all the big Indian cities are dug up for the construction of roads, bridges, metro rail networks etc., there are gaps between the target and achievement in a large part of the National Infrastructure Pipeline (NIP).

NaBFID had a lending target of ₹5 lakh crore to be achieved in the 3 years starting 2021. Last month, the government cut the target to ₹3 lakh crore and stretched the deadline to March 2026.

So far, NaBFID’s sanctions stand at ₹87,000 crore, less than 18% of the original ₹5 lakh crore target.

Similarly, the asset monetisation program, which was designed to support the increased spending on infrastructure, has missed crucial targets in recent years. After growing at 25%-30% over the last three years , the pace of central govt capex has slowed down in the current financial year.

First, the government has lowered its capex budget for FY24 by ₹50,000 crore to ₹9.50 lakh crore. The capex for FY25 is estimated at slightly over ₹11 lakh crore, 17% more than the current year’s revised allocation.

The progress in India's bad bank

Its goal was to take over the bad loans and create room for the banks to make better loans to productive enterprises. The process began late in 2023, spilling over to early 2024 and now, there are questions on its efficacy.

The initial target was for the bad bank to take over ₹2 lakh crore worth of bad loans by March 2022. The target has been revised to ₹1 lakh crore by March 2024.

Hope floats that Prime Minister Modi will deliver on at least some of this unfinished business , for whom a third straight term as the next PM is all but given according to the latest opinion polls.

(Edited by : Sriram Iyer)

First Published: Mar 19, 2024 3:49 PM IST

The RBI’s Financial Stability Report said that the government-owned general insurance companies are well short the required solvency ratio, which shows the financial health of these copmanies.

The RBI’s Financial Stability Report said that the government-owned general insurance companies are well short the required solvency ratio, which shows the financial health of these copmanies. BE stands for budget estimate

BE stands for budget estimate