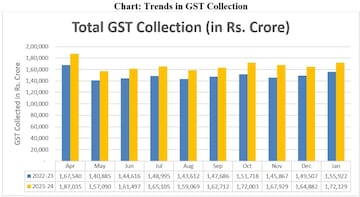

The gross goods and services tax (GST) collection rose 10.4% to over ₹1.72 lakh crore in January 2024. These numbers are till 5 pm on January 31, 2024, and the final numbers will be higher and are likely to be released in the next few days.

Chart: Trends in GST Collection. Image source: PIB

Chart: Trends in GST Collection. Image source: PIBAt ₹1,72,129 crore, the GST collections are the second highest ever and have crossed the ₹1.7 lakh crore mark for the third time during the current financial year. GST collections in January 2023 were ₹155,922 crore.

GST revenue collection for January 2024 is second highest ever, at ₹1.72 lakh crore records increase of 10.4% YoY#GST #GSTRevenue #JanuaryGST pic.twitter.com/aDlhj81tk6

— CNBC-TV18 (@CNBCTV18Live) January 31, 2024

The government has settled ₹43,552 crore to CGST and ₹37,257 crore to SGST from the IGST collection.

During the April 2023–January 2024 period, cumulative gross GST collection witnessed 11.6% year-over-year growth (till 05:00 PM of 31.01.2024), reaching ₹16.69 lakh crore, as against ₹14.96 lakh crore collected in the same period of the previous year (April 2022–January 2023).

Experts react on January GST collections

The higher mop-up indicates improved tax administration and compliance, said Saurabh Agarwal, Tax Partner, EY.

"The recent surge in GST collections, culminating in a record-breaking month, underscores the strength and resilience of the Indian economy. This consistent upward trend, evident in surpassing key milestones, reflects the effectiveness of improved tax administration and heightened taxpayer compliance. Overall, these positive indicators pave the way for continued economic expansion and self-reliant India," Agarwal told CNBC-TV18.

MS Mani, Partner, Deloitte India sees the second highest ever GST collections creating "more headroom" for the next level of GST reforms.

He said, "Coming on the budget eve, the second highest ever GST collections would provide even more headroom for embarking upon the next stage of GST reforms. These collections relate to supply transactions of goods and services during December 2023, where there was considerable emphasis on completing audits and investigations relating to earlier years. The GST collections are in line with the other macroeconomic parameters, which indicate a significant uplift in economic activities, with even the IMF upgrading the growth forecast to 6.7% for FY23–24. The same collection trajectory in the next two months will ensure that the tax collection targets for the year are comfortably surpassed."

Calling it a "big cheer" for the economy, Abhishek Jain, Partner & National Head, Indirect Tax, KPMG, said, "The consistent growth in GST collections, with this one being the second highest collection ever, is a big cheer for the economy. One significant reason for this growth could be linked to voluntary payments by businesses for FY22–23 during the finalisation of annual returns and reconciliation statements in December.”

(Edited by : Ajay Vaishnav)

First Published: Jan 31, 2024 7:57 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM