Headline CPI Inflation for December rose to 7.35 percent, the highest in more than 5 years. More importantly, inflation is now above the upper threshold of 6 percent for the Monetary Policy Committee (MPC). If the inflation remains above 6 percent for another 8 months, the RBI will have to write a report to the government explaining why it has failed to contain inflation. The RBI would not want to be in such a situation and thus, inflation crossing 6 percent is an important threshold being breached.

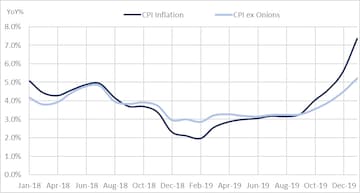

So, what is driving the uptick in inflation? Food inflation, of course. Food inflation has risen to over 12 percent YoY, the highest in 6 years. And within food inflation the key contributor is onions. Onion prices have quadrupled on a YoY basis and almost two-thirds of the 12 percent food inflation is attributable to the rise in onion prices. That said, food inflation is not being driven just by onions although they are the dominant driver. Most key categories of food inflation have trended up in the last few months as the chart below depicts. Indeed, even within vegetables, it is not the case that only onions are driving price rise. Several items of vegetables such as cauliflower, cabbage, radish, carrot, garlic and chillies have seen double-digit price increases in the last 2-3 months. It is just that none of them has seen the kind of swings that onion prices see. Thus, excluding onions, overall inflation drops from 7.35 percent to 5.2 percent -- low but not quite benign as it is well above the 4 percent target.

There is a bright side though to the current inflation trends. And that is the benign core inflation. Core inflation has remained below 4 percent for 4 consecutive months and is close to its lowest for this series which began in 2012. And as I have written before, this distinction between what is driving inflation matters. A high inflation reading driven by high core inflation (but low food inflation) is, ceteris paribus, more worrying than high inflation reading being driven by high food inflation (but low core inflation). This is because core inflation tends to be stickier than food inflation due to it being driven by underlying economic rigidities. Food inflation can also be driven by underlying rigidities in agriculture but is often driven by transitory factors. Already onion prices have started to retrace and have fallen 15 percent in just the past week and are down 30 percent over the past month. It is very likely that inflation drops below 6 percent in the next couple of months and stabilises in the 5-6 percent range. So, the 7 percent headline inflation is less worrying, given its composition and recent price trends, than what it first appears.

And it is not the case that the inflation targeting framework has tied the hands of the MPC into an automatic policy response to high inflation. Firstly, as discussed above, inflation is likely to fall back below 6 percent in the next couple of months and thus it will no longer be higher than the outer bound of its target. Second, the MPC has a flexible inflation targeting mandate which means that there is a secondary mandate of growth to the primary mandate of inflation. This means that if inflation is likely to remain below the upper threshold of 6 percent (as I think it will in a couple of months), the MPC has the flexibility of how to weigh the relative growth-inflation dynamics, especially in the short-run.

And it is important to keep in mind that the backdrop to this is the weak state of the economy. This is in a sense what the core inflation is mirroring. The initial few data for December all suggest that economic activity continues to remain weak. And December quarter growth is likely to be around 5 percent. So, a tight monetary policy is probably the last thing the economy needs right now. So, the policy prescription from the MPC is to stay on the side-lines for now and carefully watch data. Any signs that high food inflation is flowing through into core inflation then the MPC must act by tightening monetary policy. But if core inflation remains benign and headline inflation remains below 6 percent, the MPC should accord a slightly higher weight to growth and let inflation run higher than the 4 percent target for a couple of quarters.

Lastly, there is growing talk of stagflation post the recent growth-inflation data. But that is an inaccurate description of the economy. For stagflation implies persistently high inflation and high unemployment (weak growth is often used as a proxy for high unemployment). And we are in just the first year of slowdown and just one month of inflation above the tolerance threshold. And as discussed above, inflation is likely to drop below the 6 percent threshold in a couple of months. It is possible that growth remains weak and inflation remains high and the economy slips into stagflation a few quarters down the line. But that is not the state of the economy currently.

Ashutosh Datar is the Founder of IndiaDataHub.com, an online platform that brings together all the public data (economic, social, financial) concerning India in a user-friendly analytical app. Before founding IndiaDataHub, he was with IIFL Institutional Equities for over a decade as their Strategist and Economist.

Read Ashutosh Datar's columns here

.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM