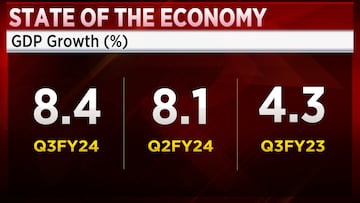

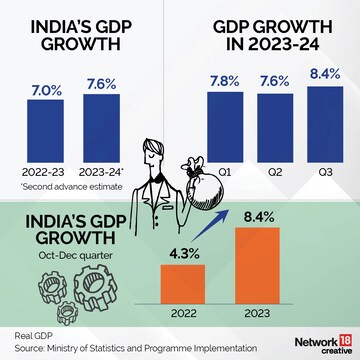

India's gross domestic product (GDP) growth for the third quarter (October-December) of the fiscal year 2023-24 has surpassed expectations, coming in at 8.4% compared to the estimated 6.7%, according to data released by the Ministry of Statistics & Programme Implementation on Thursday, February 29.

This growth rate surpassed economists' forecasts, which had projected 6.7% as per a Reuters poll, and was higher than the revised growth of 8.1% in the previous quarter. It's the second consecutive quarter where the government's GDP estimate has exceeded street expectations.

The National Statistical Office's (NSO) second advance estimate also forecasts a higher GDP growth rate of 7.6% for the entire fiscal year, up from the initial estimate of 7.3%.

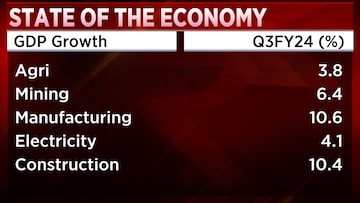

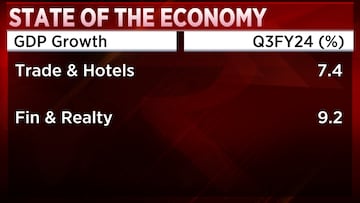

Notably, the growth in the third quarter was primarily driven by double-digit expansion in the manufacturing sector at 11.6%, closely followed by the construction industry, which recorded a growth rate of 9.5%.

Despite this positive trend, the agriculture sector's gross value added (GVA) experienced a contraction of 0.8%

'Unlikely to be sustainable'

Economists elaborated on the "sharp upside surprise" in the GDP number announced ahead of the general election. "The Q3 data on India's growth threw up a divergent trend, with the GVA growth moderating broadly on expected lines to 6.5%, and the GDP expanding by a much higher than anticipated 8.4%. This wide gap followed from a surge in the growth of net indirect taxes to a six-quarter high of 32% in this quarter, which is unlikely to be sustainable," said Aditi Nayar, Chief Economist, Head Research and Outreach, ICRA Ltd.

"Amidst the sharp upside surprise in the headline GDP growth number, the contraction in the GoI's revex and capex, as well as the slide in the core sector growth in January 2024, offer some sobering trends," Nayar added.

Suman Chowdhury, Chief Economist & Head of Research, Acuité Ratings, said, "One of the key reasons for the material shift in the GDP print is the revisions in the GDP data for some quarters of the previous fiscal."

"What is noteworthy is the significant differential between GVA (6.5%) and GDP (8.4%) growth in the third quarter. The manufacturing sector has grown by 11.6% YoY in Q3FY24 which may be partly due to higher operating margins driven by lower raw material costs... Given the revised GDP data, we may need to rework our estimates for FY24. Clearly, the higher-than-expected momentum in the economy may lead to a tight monetary policy from RBI for a longer period and any reversal in the current stance is unlikely over the next six months," Chowdhury added.

Madhavi Arora, Lead Economist at Emkay Global Financial Services said, “I think we all have underestimated India’s underlying growth story. At the beginning of the year if you had asked any of us if we are expecting 7% growth in FY24? Most of us would have been sceptical. Most of the forecasts were hovering close to sub 6.5%. We all have gone through the year and every quarter the number has surprised on the upside. Historical data also has been revised up on a net basis which shows that the revised data which also incorporates the unorganised sector has not been as weak as we initially estimated. So it shows that the underlying momentum has been somewhere missed by most of us.”

“Unfortunately, what I am seeing at least for this particular year is that there has been very wide divergence on a quarterly basis between private consumption and gross fixed capital formation (GFCF). So you are coming to a situation which is very much like a China growth model in the 2003-2012 period where you see a massive growth in investments but not a very strong consumption story. However, China was an export led economy and so they were able to export that excess capacity outside of their economy and could lower the deficit level. In India currently you don’t have a very strong consumption demand, but the investment capacity has increased massively over the last couple of years and exports have remained sideways if not weakened in FY24. So that implies that the excess capacity is going to stay in the country given that we are not a export led economy and would eventually lead to a supply led fall in inflation domestically. And that is reflected in the fact that in the last one year the core inflation has been steadily coming off while food has been volatile for whatever reasons. So the intrinsic demand in the economy is relatively low, while supply side is actually improving dramatically. So the near term impact will be lower intrinsic inflation, but maybe in the medium term you could actually see a higher potential growth also,” Arora added.

First Published: Feb 29, 2024 6:07 PM IST