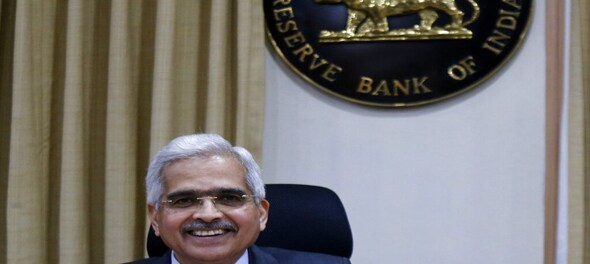

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday, October 20, said that global economic activity is facing deceleration due to stringent financial conditions, however, in contrast, the domestic economic situation in India presents a more optimistic picture, and is projected to grow at a rate of 6.5% for the fiscal year 2023-24.

The RBI on Friday released the minutes of the Monetary Policy Committee (MPC) meeting held on October 6. In his statement at the meeting, Das noted that major economies continue to grapple with elevated inflation levels, potentially leading to a prolonged period of tight monetary policy in advanced economies. However, he said that the resilience displayed by the global economy has exceeded prior expectations.

"Headline inflation is moderating, but it remains above target levels in major economies. Monetary policy settings could remain tighter for longer in major advanced economies. Growth remains uneven in many of these countries," he said.

Against the backdrop of this challenging global environment, Das said, "domestic economic activity in India has exhibited resilience, with growth projected at 6.5 percent during 2023-24. India is poised to become the new growth engine of the world backed by its strong domestic macroeconomic fundamentals and buffers."

He further said that the balance sheets of banks and corporates are strong and healthy. Various sectors, including construction, travel, transportation, and financial services, continue to perform strongly, and the upcoming festival season is expected to further boost consumer spending. Moreover, private sector investment is on the rise, thanks to easing input cost pressures, and consumer outlook surveys have taken on a more optimistic tone.

"Both manufacturing and services PMI readings indicate a healthy expansion in these sectors. The external sector has remained eminently manageable, despite global headwinds," the Governor added.

In terms of inflation, India experienced heightened pressures during July and August 2023, primarily due to a spike in vegetable prices. This situation underscored the vulnerability of headline inflation to recurring food price shocks, often driven by adverse weather events. "Adverse weather events – unseasonal rains, skewed monsoon rainfall and unprecedented heat waves – have been major sources of food inflation pressures in recent years," Das said.

However, he added that with corrections in vegetable prices and other measures, inflation is expected to fall below the upper tolerance level of 6%.

"The spike in vegetable prices has likely corrected substantially in September and inflation is expected to fall significantly below the upper tolerance level of 6 per cent. The moderation in inflation in September would also be aided by the sharp reduction in household LPG prices in end-August. The projections suggest that throughout much of Q3:2023-24, food inflation pressures may not see a sustained easing, but ample buffer stocks of food grains, softening edible oil prices, and government’s proactive supply side interventions are expected to keep check on unusual price spikes of key food items," he said.

Nevertheless, uncertainties persist, particularly in the inflation outlook, influenced by factors like adverse weather events, global food and energy prices, and financial market volatility. The RBI's monetary policy aims to ensure the smooth progress of the ongoing disinflation process.

The RBI anticipates that liquidity in the banking system will remain adequate to meet the economy's productive requirements. Despite uncertainties, "the Reserve Bank has maintained a flexible and adaptive approach to liquidity management. It will remain nimble footed and ensure that liquidity is actively managed by undertaking whatever operations are necessary from time to time, including open market operation sales (OMO-sales)," Das said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM