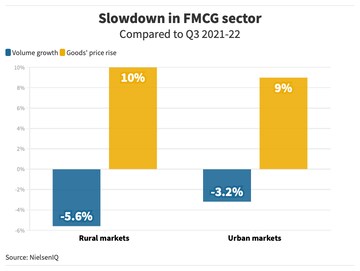

India’s fast-moving consumer goods (FMCG) sector saw consumption slowdown in the January to March quarter as compared to the same period last year. According to data from NielsenIQ, the sector grew six percent in the quarter, driven largely by double-digit price hikes across product categories. Volumes for the quarter were down 4 percent, while prices rose 10.1 percent The sector had seen a 9.6 percent growth in the previous (October-November) quarter.

Rural markets were worst hit, with consumption dipping to its lowest level in three quarters as goods got costlier. Last quarter, consumption had declined 4.8 percent in the same period.

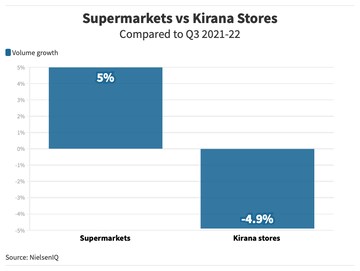

Similarly, modern trade, or supermarkets, performed better than traditional stores with volume growing 5 percent as against a decline in kirana stores by 4.9 percent. This shrinkage was led by a shift towards smaller packs.

As prices pinched, consumers focused on kitchen essentials even as their prices increased. NielsenIQ data shows that volume decline is significantly higher in non-food categories (9.6 percent down) compared to food (1.8 percent down). Staples like edible oil and packaged atta saw prices increase 15 percent, while volume dropped 1.9 percent. But homecare and personal essentials saw nearly 10 percent volume decline each, as prices rose 10-11 percent.

Surprisingly, impulse categories saw some growth led by small packs of salty snacks, chocolates and confectionary and possibly the early onset of summer. And as evidenced in comments from companies, price hikes and consumption decline is being seen in the current quarter as well.

“Consumers are scaling back more on discretionary spends within the non-food categories. Overall, there is an evident shift by consumers to smaller pack sizes to manage external factors for both foods and non-foods,”said Sonika Gupta, Customer Success Lead (India), NielsenIQ.

First Published: Jun 1, 2022 8:02 PM IST