The US and Indian stock markets are in risk-off mode lately with the slew of inflation data both in the US and India. China is of course a world of its own battling low inflation and low growth.

In an interview with CNBC-TV18, Rob Subbaraman, head of global macro research at Nomura, and Aditya Bhave, senior US economist at Bank of America discussed the global backdrop world should be prepared for in the next three quarters of 2023 as economists around the world are keeping a close eye on inflation rates, as concerns over rising prices continue to grow.

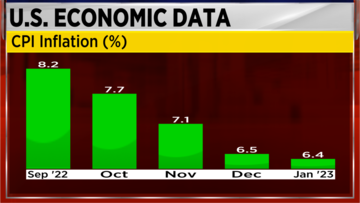

According to Bhave, "US inflation surprised to the upside," indicating that the inflation rate was higher than anticipated. He pointed out that "core goods prices rose 0.5 percent on a month-on-month (MoM) basis in January," which could be contributing to the increase in inflation.

Bhave also warned that "risks are to the upside when it comes to rate hikes in the US," suggesting that there is a possibility that interest rates in the US may rise in response to the inflationary pressures.

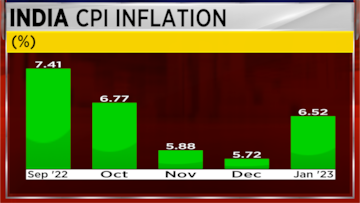

Meanwhile, Subbaraman said inflation is a global phenomenon. He stated that "the pandemic, pent-up demand, and supply are a few reasons for inflation," highlighting some of the key factors contributing to inflation rates worldwide.

However, Subbaraman expressed concern about the impact of inflation on emerging markets like India, saying that "India and other EMs are troubled with a darkening growth outlook." This suggests that rising inflation rates could have a particularly negative impact on developing economies, potentially leading to slower growth and economic instability.

He said, "India and EMs, right now, are troubled with quite a sharp slowdown in exports and a darkening growth outlook.”

For the entire discussion, watch the accompanying video