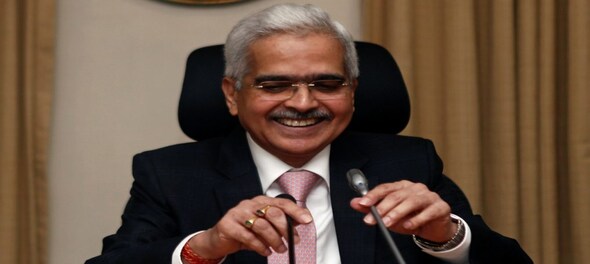

The Reserve Bank of India (RBI) Governor Shaktikanta Das (RBI) on Monday (February 12) said he is confident of the central government sticking to its fiscal glide path of bringing the deficit below or to 4.5% levels by the end of the financial year 2025-26.

On how credible the government's fiscal consolidation plan is, Das stated categorically, "The market was expecting 5.2%, 5.3 %but it is 5.1%. So therefore I think there is every reason to believe the government will adhere to the path of fiscal consolidation, whether 30, 40, 50 we would not like to comment on that."

Speaking to reporters after the central bank’s customary post-budget board meeting with the Finance Minister in New Delhi, the Governor said he also expects the cut in FY25 government borrowing to help stabilise and moderate inflation.

"...lower quantum of borrowing, therefore, I would say is growth inducing and it has a positive impact, positive in the sense it would help to stabilise inflation, how much it would help to stabilise I would not like to quantify but it does help to stabilise inflation and it should help in moderating the inflation levels," Das said.

On being asked why the government's interest payments are continuing to show an upward tick, the Governor explained, "Interest payments as a quantum are linked to the bond yields.. so going forward when inflation is brought under control I think bond yields will soften and the borrowing costs of the government should also come down, the 10-year bond yield in any case has started softening and the 5 years also. The bulk of the government borrowing is in these two buckets."

Despite a lower gross market borrowing target of ₹14.13 lakh crore for FY25, the government's interest costs for the next fiscal are pegged higher than the current fiscal at close to ₹12 lakh crore (₹11.90 lakh crore). In other words, interest payments comprise over 84% of the government's FY25 market borrowings or 70% of the ₹16.85 lakh crore fiscal deficit.

"When inflation is high central bank has to take monetary policy action by increasing the rates so naturally the government borrowings done during that period the cost will be higher but as we move forward as inflation has started moderating, going forward when inflation moderates, logically the final point will be where the bond yield also comes down," RBI Governor explained.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM