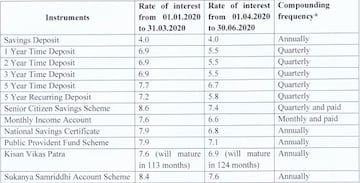

The government has cut the small savings interest rate on a number of instruments from anywhere between 70 basis points to 140 basis points. A basis point is a hundredth of a percent.

The government cut the rate on the Public Provident Fund (PPF) for the April-June period by 80 bps, or from 7.9 percent to 7.1 percent.

It slashed the National Savings Certificate (NSC) rate by 110 bps from 7.9 percent to 6.8 percent.

The rate on Kisan Vikas Patra has been slashed by 70 bps, from 7.6 percent earlier to 6.9 percent.

The rate on 5-year recurring deposit has been cut by 140 bps from 7.2 percent to 5.8 percent while that on time deposits has been slashed by 100 bps, from 7.7 percent to 6.7 percent.

Rates on small savings schemes are revised on quarterly basis.

The government walks a tightrope to balance the interest of savers and borrowers while deciding on the interest rate for savings schemes: very low interest rates hurt savers while high-interest rates make it difficult for banks to cut their own rates on instruments such as fixed deposits. Since banks to continue to pay high interest to their savers, they are effectively not able to lower their lending rates as well.

The MPC in its February Bi-monthly Monetary Policy Statement said that while there is a need for adjustment in interest rates on small saving schemes, the external benchmark system introduced from October 1 last year has strengthened the monetary transmission.

Department of Economic Affairs Secretary Atanu Chakraborty had recently hinted at a revision in small savings rate next quarter, in line with market rate, a development that could lead to speedier transmission of monetary policy rate.

"In India, right now we have about Rs 12 lakh crore in small savings schemes and roughly Rs 114 lakh crore in bank deposits. So the liability side of banks is getting affected by Rs 12 lakh crore. When banks say this, it seems a bit of a tail wagging the dog situation," Department of Economic Affairs Secretary Atanu Chakraborty had said last month.

First Published: Mar 31, 2020 8:11 PM IST