As the latest US jobs data has surpassed consensus expectations, it indicates a robust labour market and suggests a potential acceleration in economic growth, according to Santanu Sengupta, India Economist at Goldman Sachs. Talking about India growth and inflation, Sengupta also predicts a likely pause by RBI from further rate cuts or hikes in the near term.

However, since the US jobs data has upped chances of one more rate hike from the Fed in July, though the June futures pricing is unchanged. Here we analyse three reasons for why is it important to India:

1. Tighter global financial conditions in the US means tighter conditions for all economies.

2. A huge part of the upside surprise in India’s Q4 GDP came from net exports and hence a global slowdown can dull growth.

3. Another rate hike from the Fed means, the RBI cut also gets pushed out.

In an interview with CNBC-TV18, Santanu Sengupta, India Economist at Goldman Sachs spoke at length about the India growth and inflation story. He is the man who upped India's GDP forecast twice in the last 10 days.

According to him, the latest US jobs data has surpassed consensus expectations. This positive development indicates a robust labour market and suggests a potential acceleration in economic growth. As employment plays a crucial role in shaping consumer spending, a stronger job market bodes well for the overall health of the US economy.

He said, “We continue to expect a pause at the June FOMC meeting, reflecting the mixed household survey, the softness in the hours worked and a decline in the average hourly earnings growth, but overall, from a labour market point of view, data is actually looking better than what expectations were.”

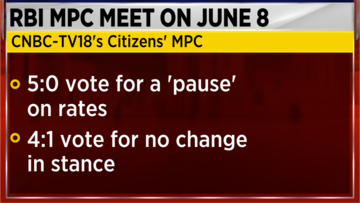

While shifting focus to the Indian monetary policy, Sengupta expects the RBI to maintain a pause in interest rate changes. This stance suggests that the central bank will likely refrain from further rate cuts or hikes in the near term. The decision to pause rates often stems from a desire to assess the impact of previous policy actions before introducing new changes.

Sengupta anticipates that the RBI will continue to retain its current monetary policy stance. This implies that the central bank will adhere to its existing framework and objectives. The RBI's stance reflects its commitment to maintaining price stability, fostering sustainable economic growth, and ensuring financial stability in the Indian economy.

In line with his analysis, Sengupta predicts that the RBI will likely maintain the repo rate within the range of 5.75-6 percent. The repo rate is the rate at which the RBI lends money to commercial banks, influencing borrowing costs and liquidity in the economy. By keeping the repo rate steady, the RBI aims to provide stability and support economic recovery.

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)