Though the US Federal Reserve's 75 bps rate hike on November 2 was largely along expected lines, Chairman Jerome Powell's hawkish comments were not. Powell's speech hinted that a pause in hikes in the near term is highly unlikely.

The tone of the Fed Chair's speech in fact worried traders so much that Wall Street saw the S&P500 close 2.5 percent in the red while the Dow Jones saw 1.5 percent shaved off. On the other hand, the US yields closed to multi-year highs after Powell said that the terminal rate — the benchmark US interest rate — is still likely to be higher than thought earlier.

2. "The important question now is how far to go... We think there's some ground to cover before we meet that test. That's why ongoing increases will be appropriate… I am pleased that we have moved as fast as we have. I do not think we have over-tightened,” Powell said. (Read more)

Bond yields recovered initial losses a few minutes into Powell's remarks, as the Fed Chair signalled a rather delayed withdrawal of steep hikes before a pause.

It is premature to talk about pausing rate increases, he said. Given the incoming data, monetary policy will have to be “sufficiently restrictive”, he said.

“It is very difficult to make the case that the current level is too tight given that inflation runs well above the Fed funds rate… I think it is a good and successful program that we have gone this far this fast. We think there is a need for ongoing rate increases. We have some ground left to cover here.”

3. “We think that we have a ways to go, we have some ground to cover with interest rates before we get to that level of interest rates that we think is sufficiently restrictive,” he said.

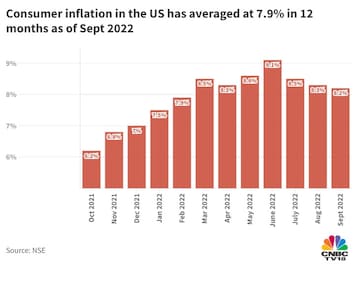

4. The Fed said it remains strongly committed to returning inflation to its target of two percent. It will decide on the pace of future hikes basis the lags with which monetary policy affects economic activity and inflation.

Recent months have highlighted:

5. "Russia's war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity," the Fed said.

The US central bank's rate-deciding panel is highly attentive to inflation risks.

Many investors expect a recession in the world's largest economy this year or in early 2023, which would force the Fed to eventually reverse some of its hikes — a hope that has helped cool down the 10-year yield from 3.5 percent in June to 2.8 percent.

How experts are reading the latest FOMC policy and Powell's commentary

Economist Ed Yardeni told CNBC-TV18 that it appears the Fed will continue to hike interest rates until inflation comes down.

"Chairman Powell really just came out with the most hawkish position I would call the Volcker 2.0, basically saying 'we are just going to raise interest rates until we find the level that starts to convincingly bring inflation down'. And that is Volcker 2.0. And I thought there was some indication that they were trying to walk that back a little bit,” Yardeni said.

Emerging markets come under pressure when the dollar is strong, he added.

For India, the underlying fundamentals continue to drive confidence about market resilience.

Dean Kim, Head of Equity Research at William O’Neil, believes the Sensex has huge support at its 20-day moving average of 59,400.

(Edited by : Abhishek Jha)

First Published: Nov 3, 2022 12:20 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Father and son reside on same street but vote for Andhra Pradesh and Telangana separately

May 7, 2024 4:40 PM

Lok Sabha elections 2024: Radhika Khera, Shekhar Suman join BJP; meet all who are now in saffron party

May 7, 2024 3:54 PM

2024 Lok Sabha Elections | Why phase-3 is a tightrope walk for all parties

May 7, 2024 1:08 PM