The Federal Reserve begins a two-day policy review on Tuesday, wherein the US central bank is widely expected to decide on a 75 bps hike in the benchmark interest rates in its battle against red-hot inflation. The scheduled meeting of the Federal Open Market Committee — the Fed's interest rate-deciding panel — comes at a time when major central banks around the globe are faced with the Herculean task of taming multi-decade increases in consumer prices without damaging economic growth amid warnings of a recession.

The US central bank has already increased the COVID-era benchmark interest rates by a total of 300 basis points in five instalments since March to 3-3.25 percent. A 75-bps hike in the range would mean a fourth back-to-back revision of this magnitude within 20 months.

The US #Fed meet stands between #Nifty and #FreshHighs; #SGXNifty suggests a gap-up. @Nigel__DSouza with all the cues pic.twitter.com/zCYofIuIvR

— CNBC-TV18 (@CNBCTV18News) November 1, 2022

Experts are of the view that central banks will ultimately have to slow down the magnitude of rate hikes in order to causing a blow to economic growth.

“You are not going to see 75 bps of rate hikes on and on. The market is expecting another 50 basis points of hike in December, and then we will see. The terminal rate we discussed last time is around five percent. Now, whether the Fed even talks to that, whether it confirms that or plays it down is what we need to see," Rajat Bhattacharya, Senior Investment Strategist at Standard Chartered, told CNBC-TV18.

He is of the view that jobs data from the US after the upcoming rate decision will need to be watched out for assessing the pace of hikes going forward.

"We are expecting a slowdown, but will (Jerome) Powell be very precise about that, I doubt,” Bhattacharya said.

Growth will slowdown in 2023 globally, and hence also in India, Krishna Srinivasan of IMF tells @latha_venkatesh. More impt, he sees the medium term India growth to be around 6%. Here’s more pic.twitter.com/MU9Ehlk0Vu

— CNBC-TV18 (@CNBCTV18News) November 2, 2022

A murmur about a global recession had started early in the year, and now the warnings are growing louder by the day. While there are concerns that the United States may tip the global economy into a recession by the middle of the next year, experts believe major parts of the world are already in recession.

US President Joe Biden has downplayed the risk of recession saying that possibility is very slight. He also added that Saudi Arabia will face action after OPEC decision for oil production cut.

His comments come at a time when top financial institutions have warned of a global recession as central banks scramble to tighten monetary policies to ease consumer prices.

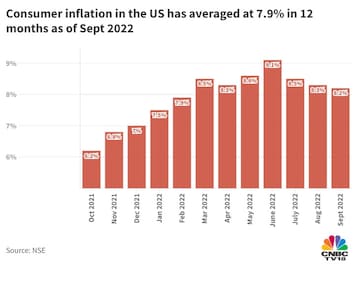

Consumer inflation in the US has eased somewhat since hitting a 40-year high in June 2022.

Consumer inflation in the US has eased somewhat since hitting a 40-year high in June 2022.Serious headwinds will likely push the US and global economies into a recession in the next 6-7 months, JPMorgan Chase & Co CEO Jamie Dimon said in an interview to CNBC. “I mean, Europe is already in recession and they’re likely to put the US in some kind of recession six to nine months from now,” he said.

US President Joe Biden, however, has downplayed the risk of recession saying that such a possibility is "very slight".

What to watch in upcoming Fed policy?

Christopher Wood, Global Head of Equity Strategy at Jefferies, told CNBC-TV18 that in his view, the Fed Vice-Chair's comments will be key to watch in the upcoming Fed event.

"She is politically connected, she is a Democrat, and she is a labour market specialist. So she will be the one to deliver the signal," he told CNBC-TV18.

Back home, the RBI's rate-deciding panel is meeting on November 3 to discuss a report to be submitted to the government explaining why inflation has not been brought under control for three back-to-back quarters.

Experts say the timing of the MPC's meeting the night after the outcome of FOMC deliberations is purely coincidental.

Meanwhile, Indian equity benchmarks have soared to 10-month closing highs as FIIs make a cautious reentry into Indian equities. Last year, the Indian market finished an 18-month-long near one-sided rally driven by consistent FII inflows. FIIs have been making purchases in the market from time to time ever since, leading many experts into believing that a reentry may not be as swift or cheap given the dollar's steady rise to 20-year highs against six peers excluding the rupee.

The rupee has, in turn, hit a series of all-time lows against the greenback in the recent past, having slid below the 83 level against the American currency for the first time ever last month.

"An interesting trend in the market is that FIIs and DIIs have reversed their roles: FIIs have turned buyers and DIIs have turned sellers in recent days... This has triggered short covering in stocks like the HDFC twins where FIIs are major holders. This trend can take the market up further," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

S&P 500 futures were up one percent at the last count on Tuesday, suggesting a gap-up opening ahead on Wall Street as investors waited for the US central bank to begin its two-day meet.

First Published: Nov 1, 2022 6:28 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections: 3rd phase sees over 65% voter participation, Assam leads with 81.71% turnout

May 8, 2024 1:00 AM

Telangana CM violated poll code, defer Rythu Bharosa payment, says Election Commission

May 7, 2024 9:01 PM

Lok Sabha Election 2024: How Indian political parties are leveraging AI

May 7, 2024 6:59 PM