The past 5 trading days have seen huge swings in the US bond markets on fears the Fed will tone down rate hikes due to the bank collapses. The US 2-year bond yields fell by over 100 basis points, in 3 days, for the first time since 1987. But now with the banking crisis appearing to wind down, attention will come back to the inflation numbers in US and India.

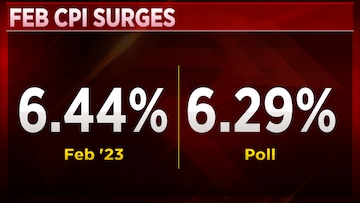

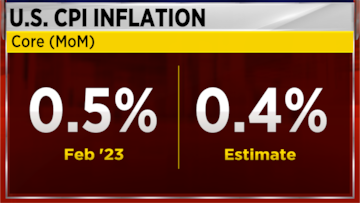

In both countries the February CPI was slightly higher than market estimates. The US core CPI has risen 0.5 percent month-on-month versus estimates of 0.4 percent; also India’s February CPI was 6.44 percent, higher than the CNBC-TV18 poll -– 6.29, definitely higher than RBI's estimates for Q4, which stand at 5.7 percent. So, will the central banks, both US and India, tone down their hikes – and have we already seen the peak rates or will we see rate cuts in the second half?

India's retail inflation for February decreased to 6.44 percent in February as against 6.52 percent in January 2023, according to data published by the Ministry of Statistics and Programme Implementation on March 13.

The Consumer Price Index or CPI measures retail inflation by examining the changes in prices of most common consumer goods and services. It is calculated for a fixed list of items including food, housing, apparel, transportation, electronics, medical care, education, etc.

In an interview with CNBC-TV18, Mitul Kotecha, Senior Emerging Market Strategist at TD Securities said, “We think the Fed will move 25-bps next week, but the Fed has to balance very finely between market uncertainty, risk aversion and on the other side of that the fact that we have got still elevated services inflation in the US.”

Meanwhile, B Prasanna, Head-Global Markets Group at ICICI Bank said, “RBI should go ahead with the hike of 25-bps irrespective of whether the Fed hikes in March or not and that is premised on the fact that in order to keep the interest rate differential between the two economies at a healthy level, this is a great opportunity.”

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)

First Published: Mar 15, 2023 3:23 PM IST