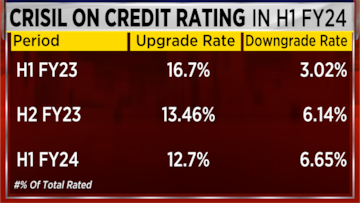

CRISIL and ICRA have released their latest readings on credit rating upgrades and downgrades of companies for the half-year period ending on September 30.

Both agencies have observed a decreasing margin between the number of upgrades and downgrades.

According to CRISIL, there were 1.91 times as many upgrades as downgrades, in contrast to the 5.52 times ratio from a year ago. ICRA noted that upgrades outnumbered downgrades by a factor of 2, whereas in the previous fiscal years, the ratio was nearly 3.

In an interview with CNBC-TV18, Jitin Makkar, Head of Credit Policy at ICRA, and Somasekhar Vemuri, Senior Director of Regulatory Affairs and Operations and Chief Criteria Officer at CRISIL Ratings, discussed these findings in detail.

To begin, Makkar pointed out that for the third consecutive year, there have been more upgrades than downgrades.

“It's always a mixed picture and we prefer to go bottom up in the sense that there will be certain sectors which will be winners, and there will be certain sectors which will be losers and the composite picture is going to be a net effect of these two. But on the whole, we expect that these trends to continue for the remainder of this fiscal,” he said.

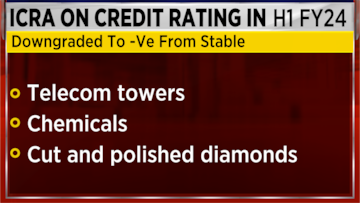

Vemuri anticipates that industries primarily influenced by commodities, such as agrochemicals and specialised chemicals, are prone to experience downward rating pressure.

He said some of the commodity-linked sectors such as agrochemicals and specialty chemicals, where the realisations are on a decline, would be under pressure. So, these sectors could see pressure building up in terms of downgrades. However, he pointed out that for a vast majority of these companies, the balance sheet is strong and should provide some degree of an offset to the downside pressure.

For the entire discussion, watch the accompanying video

(Edited by : Shweta Mungre)