The Turkish Central Bank recently announced a staggering increase in interest rates, raising them by 6.5 basis points. This substantial adjustment brings the rates from 8.5 percent to 15 percent, indicating the gravity of the situation the country faces. The central bank's proactive approach reflects its determination to curb rampant inflation and restore macroeconomic stability.

Turkey has raised rates because inflation is running at 40 percent. However, expectations among the local businessmen were that they would raise it to 20 percent because inflation is at 40 percent, but the most important part is that it signifies a U-turn in Premier Erdogan’s policy, he had followed an unorthodox policy of keeping rates artificially low when inflation was running between 20 percent and 40 percent.

So, it is clearly an indication that the policy has not worked and therefore more orthodox policy is coming in Turkey as well. Some international experts have also been appointed.

Four big central banks, including Tukey, raised rates. Bank of England raised by 50 basis points, taking the interest rate over there, the benchmark rate to 5 percent, which is the highest since the global financial crisis of 2008. And that is because their inflation came in at 8.7 percent, totally unacceptable.

The Swiss National Bank was the one that was lesser expected because Switzerland is the country with the lowest inflation, but even there, people were expecting 50 basis hikes.

Norway's central bank called the Norges Bank has up rates by 50 basis points. And this, like in England, is taking the overall rate to 5 percent, which is 15 years highest since 2008.

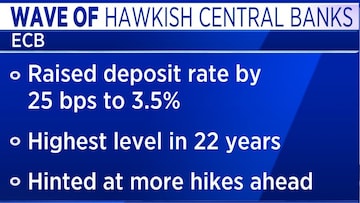

The other central bank, which is not exactly the benchmark rate, is European Central Bank (ECB), which has raised its deposit rate by 50 basis and it has signified that it is not done or hinted that it is not done with rate hikes.

Among those who spoke, Jerome Powell completed his testimony to Congress on Wednesday, and among the last thoughts was if you are guessing that we are increasing rates then that is a very good guess. But for what it is worth he did say that it would be at a careful pace. So perhaps not rapid or consecutive increases in rates. As the dot plot in the previous FOMC meeting had indicated two more hikes from a majority of 9 out of the 18 FOMC members.

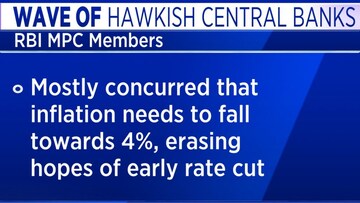

And finally, India’s Monetary Policy Committee had more people saying that they would like to see inflation at 4 percent. Until now, we had more of the RBI members saying it, but yesterday in the MPC minutes even Jayanth Varma, the external member, and Shashanka Bhide said that they are not comfortable with inflation at current levels and that they should see it coming towards 4 percent target.

Only one member, Ashima Goyal said that very high real rates can be dangerous; the real rate is the difference between the nominal interest rate and inflation. Especially if you look one year down the line, Ashima fears that it could rise to 200 basis points, interest rates over inflation and that could be dangerous.

But what is the result of all this? The result of all this is of course, there is a bit of risk aversion globally, the dollar has become stronger and most Asian currencies are weaker. India for instance, had to follow in the footsteps of the yen and yuan by which it is impacted, and the rupee also is weaker.

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)

First Published: Jun 23, 2023 3:27 PM IST