Sonal Varma, MD & Chief Economist at Nomura India is factoring in cumulative interest rate cuts of 100 basis points by the Reserve Bank of India (RBI) in the next financial year (FY25) with the first cut likely in August.

The Reserve Bank of India's (RBI's) Monetary Policy Committee (MPC), on February 8, decided to leave the repo rate unchanged at 6.5% for the sixth straight time.

Speaking to CNBC-TV18, Varma said Nomura India has revised its growth projection slightly upward for FY25. The forecast for India in FY25 has been increased to 6.2%, up from a previous projection of just below 6%. The estimates are below the (RBI projection of 7%.

Regarding factors affecting growth, Varma highlighted expectations of a slowdown in capital expenditure (capex) due to it being an election year. Additionally, tightening measures on liquidity and macro-prudential norms are anticipated to lead to a cooling off in discretionary consumer demand, which has been factored into their forecast.

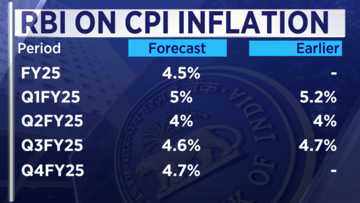

Discussing inflation, Varma said that Nomura India's projections align with the RBI's aggregate projection of 4.5%. However, their one-year forward projection for the last quarter of FY25 anticipates inflation to be around 4%, lower than the RBI's estimate of 4.7%.

Sharing his view on RBI's status quo on its 'withdrawal of accommodation' policy stance, Suyash Choudhary, Head- Fixed Income at Bandhan MF said, “The way we are thinking about this is there is a rationale given for the stance, which is incomplete transmission and inflation yet to be aligned to 4%. And then there is a context to the stance which is that RBI still thinks FY25 growth is going to be 7%. Now, if there is a rethink going forward basis concurrent data that growth outcomes may be slightly less strong compared to what RBI is estimating today or if there were global events that were to pose the hand, then the stance will not come in the way of any sort of a rate cut in the future.”

(Edited by : Shweta Mungre)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive | Full text of the PM interview: Modi's agenda for the next 5 years

Apr 29, 2024 10:28 PM

PM Modi says he’s going forward with a positive attitude as a response to personal attacks

Apr 29, 2024 10:08 PM