The consumer price index (CPI) inflation figures for April will be released at 5:30 pm on Friday, May 12. Based on a CNBC-TV18 poll, the expected number is 4.79 percent, compared to March's figure of 5.66 percent. Previously it dropped below the 6 percent mark in March, but it's crucial that we have now dipped below 5 percent in April.

This reduction is due to a large base effect, but it's being closely monitored because the RBI and the MPC have the mandate to maintain the inflation target at 4 percent — plus or minus 2 percent.

Therefore, ideally, the figure should be around 4 percent, and we are currently heading towards that mark for the first time in approximately 18 months.

The reason for the favorable 4.79 percent CPI inflation number in April can be attributed to the high inflation base caused by the Ukraine war in the previous year.

The core CPI, which excludes food and fuel, is also expected to decrease to 5.1 percent based on a CNBC-TV18 poll, compared to the previous months' figure of around 6.1 percent. This decline can be attributed to a high base and the cooling of commodity prices, which is also causing a decrease in the Wholesale Price Index (WPI).

Now, a combination of this score at 5.1 percent and headline inflation falling even below 5 percent would mean that rate hike fears will be out. But when inflation falls below 5 percent that feeling or that reassurance will be reiterated.

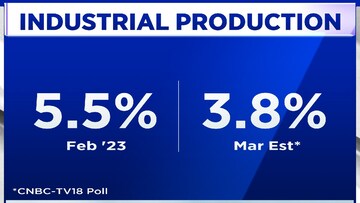

The Index of Industrial Production (IIP) for March is expected to decline to 3.8 percent. In the previous month, February, the IIP was 5.5 percent, and the average from April to February was also 5.5 percent.

However, this slowdown could be because of a very high base year ago March. Also because they were unseasonal rains, and that may have dampened some activity, but somehow the industrial production expectation is not very good.