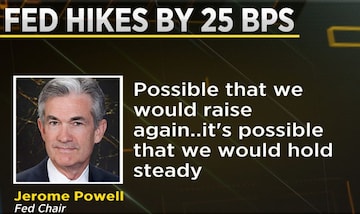

The US Federal Reserve has once again started increasing interest rates, and Chair Jerome Powell has indicated that there might be more rate hikes in the future. Powell stressed that these potential future hikes would be contingent upon incoming data, which has recently indicated the strength and resilience of the US economy.

In an interview with CNBC-TV18, Robert Sockin, Global Economist at Citi spoke at length about the central banks' strategies and expectations for a rate hike by the Federal Reserve (Fed) in the coming year. He also spoke about the resilience of the US economy, attributing its strength to the significant contributions from the services sector.

He weighed in on the likelihood of the

Federal Reserve implementing another rate hike this year. The Fed plays a crucial role in shaping US monetary policy, and its decisions have a ripple effect on the global financial markets. According to Sockin's predictions, he expects "one more rate hike by the Fed this year."

“They are going to end up pausing in September, but there is going to be enough persistence in inflation to lead them the hike one more time in November,” he said.

One of the key points discussed by Sockin was the response of central banks to the mounting inflationary pressures. With inflation rates rising in several economies, there have been concerns about the potential risks to economic stability. He also expressed confidence in the central banks' commitment to addressing this issue, stating that their "base case is that

central banks will continue to do more to tackle inflation."

While talking about US growth amid global uncertainty, Sockin highlighted the unexpected resilience of the US economy. Despite uncertainties stemming from the pandemic and other global challenges, the United States has demonstrated remarkable strength in its growth trajectory. Notably, Sockin stated that "US growth along with the globe is more resilient than expected."

According to him, the key driver behind the robust growth in the US economy is the services sector. As the backbone of the nation's economic activity, the services sector has emerged as a significant contributor to GDP growth and employment.

Sockin pointed out that "most of the growth is coming from the services sector," underscoring its pivotal role in propelling the economy forward.

(Text input from Bloomberg)

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)