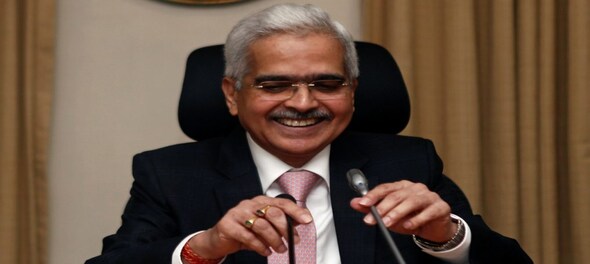

Reserve Bank of India (RBI) Governor Shaktikanta Das said that Central Bank Digital Currencies (CBDCs) is going to be the future of the money emphasizing the increasing prominence of CBDCs. He stated that the RBI is actively preparing for this transformation, recognizing CBDCs as the future of currency.

"CBDC is going to be the future of money. Therefore, we are preparing ourselves for that. By the end of this month, we hope to reach about 1 million users of retail CBDC. That is for domestic payments. But cross-border payments will also become much quicker, more seamless and very cost-effective. That is another area where a lot of attention needs to be given. We are constantly in dialogue with other central banks that have introduced or are

introducing CBDCs. That is going to be the future," Das said.

In an interview with centralbanking.com after receiving the prestigious "Governor of the Year" award, Governor Das discussed the importance of developing credible self-insurance and sizeable foreign exchange (FX) reserves, while also highlighting the inter-dependence between the central bank, government, and regulatory reforms for non-bank and bank sectors. In addition, he discussed significant topics such as demonetisation, rupee internationalisation, and the remarkable milestone of daily UPI payments reaching 300 million transactions.

Das discussed the challenges the RBI faced upon his joining in 2018 and highlighted the collaborative relationship between the central bank and the government.

Governor Das pointed out two significant challenges the RBI encountered at the time "One, GDP growth was already showing signs of moderation. And two, the financial markets had almost been frozen due to the collapse of a large nonbank financial lender. There was no liquidity flow. But more than that, a lack of confidence was slowly building up in the system," he said.

To address these concerns, the RBI initiated a rate-cut cycle in February 2019, starting with a 25-basis-point rate cut and followed it up with additional cuts throughout the year.

"Inflation was well below our 4 percent target, so we started a rate-cut cycle in February 2019. We did a 25-basis-point rate cut, and we followed it up during that year with a few more rate cuts," he said.

Speaking about the relationship between the central bank and the government, Governor Das emphasised the importance of constant dialogue. He stated that this relationship, based on interdependence, requires ongoing communication.

"The relationship between the central bank and government, in any scenario, in any country is one of interdependence. Therefore, the relationship has to be based on a constant dialogue. To bring about improvements in the financial sector, we need legislative changes," However, he added that the changes to the law can only be undertaken by the government.

"So, you need to build up that kind of a working relationship with the government because we need their support. In the same way, the government also needs the central bank’s support in many situations – for instance, if there is a liquidity problem."

Governor Das clarified that maintaining a dialogue does not imply compromising the autonomy of the central bank. Ultimately, the RBI retains the freedom to make its own decisions. However, open communication allows for the sharing of concerns and ensures that both the central bank and the government work toward the same objective of fostering a healthy economy.

"A dialogue does not mean a compromise of autonomy at all. In the end, you decide what you want to do. But it is useful to share each other’s concerns. In any case, both have the same objective, both are working for the economy." he said.

Regarding the Indian banking sector, Governor Das expressed confidence in its stability and health. "Supervision is an area we have really strengthened...All the parameters in terms of capital adequacy, liquidity, percentage of stressed assets – from any parameter you measure, the banking sector is stable and healthy," Das said.

He further highlighted the Reserve Bank of India's (RBI) priorities in managing reserves. He said, "Like any central bank, we have three priorities. The first is safety, the second liquidity, and the third is return. We have engaged some external asset managers, but that is only to gain experience, it is not a change in strategy. The RBI continues to manage its own reserves."

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: What rural Delhi wants

May 16, 2024 10:10 PM

Over 50 onion farmers detained in Nashik ahead of PM Modi's visit

May 16, 2024 11:14 AM

Why Google CEO is cautiously optimistic about the election year

May 16, 2024 9:51 AM

Mark Mobius reveals how markets will react if NDA wins 400+ Lok Sabha seats

May 15, 2024 8:09 PM