RBI Governor Shaktikanta Das on Monday said that banks keeping a close watch on non-performing assets (NPAs) was the need of the hour even as the central bank shifts its focus to containing inflation from growth.

Das, in an interview with CNBC-TV18, said that expecting more repo rate hikes in upcoming monetary policy meetings was a 'no brainer'.

The RBI, in an unscheduled monetary policy announcement earlier this month, hiked the repo rate — the rate at which the central bank lends money to commercial banks — by 40 basis points to 4.4 percent. One basis point is one-hundredth of one percentage point.

Experts suggest the central bank should hike the key rate by at least 100 basis points to control inflation which has hit multi-year high recently.

Consecutive hikes in interest rate force banks to raise their lending rates. This, amid a relatively slow growth rate, leads to impact on the borrowers' capacity to pay debt.

Das told CNBC-TV18 that both public sector and private banks have been alerted on the need to maintain NPAs in check. He highlighted that the overall gross non-performing assets (GNPA) for the banking sector are at 6.5 percent. However, on a positive note, collection efficiency has improved for banks, so the situation is not grave as of now, mentioned Das.

“You see the GNPA or the gross NPA remains at 6.50 percent. The currency and finance report was basically saying that this is an area which has to be watched, because it depends on again, so many factors — how the salaries of people are coming, the EMIs and other payments,” he said.

“The collection efficiencies have improved in almost all the banks, and they are almost at 100 percent," said Das, adding that lenders have raised substantial amount of capital during the COVID period and have various capital raising plans going forward as well.

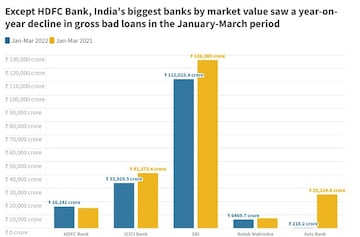

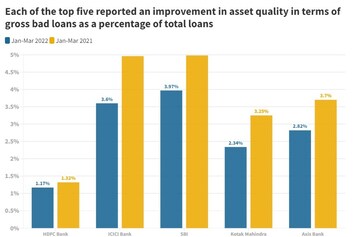

Here's a look at GNPA as percentage of total loans:

(source: Moneycontrol)

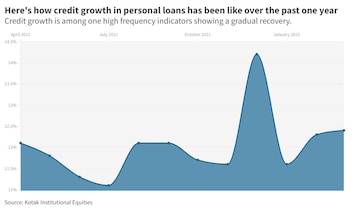

On being asked if the interest rate hikes will have a dampening effect on banks’ credit offtake, Das explained that there are numerous factors besides interest rate which affect a lender's credit growth such as consumption, demand, the overall macroeconomic fundamentals and so on. He expects bank credit growth to remain steady.

“Credit offtake depends on a multiplicity of factors. It depends on how well the economy is doing, how the private consumption, private demand is picking up," said Das.

"I think bank credit offtake should remain steady. The latest number I have... is of bank credit growth being about 11 percent year-on-year,” said Das.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM

BJP replaces Poonam Mahajan with lawyer Ujjwal Nikam for Mumbai North Central Lok Sabha seat

Apr 27, 2024 7:53 PM