The Centre is keen to sell its stake in the Bharat Petroleum Corporation Ltd (BPCL), sources told CNBC-TV18, adding that whether it will meet the March 2023 deadline still remains uncertain. The government may also re-examine the terms of sale to enable investor interest, they added.

If the finer points of the strategic sale terms are reworked, fresh approvals may be required.

As part of the Centre's mega disinvestment plan, BPCL's stake sale hasn't progressed at the desired pace. The proposed privatisation plan, worth Rs 43,000 crore, has been delayed for more than a year.

BPCL is India's second-largest state-run refiner and forms the lion's share of the government's disinvestment target.

Vedanta and private equity firms Apollo Global and I Squared Capital's arm, Think Gas, have shown interest in the sale in the past.

The government aims to sell its 52.98 percent equity in

BPCL to private entities, and complete the process in the financial year ending March 2023.

It has not called for financial bids yet. Companies with a net worth of more than $10 billion can bid for BPCL under the plan. BPCL will give the buyer ownership of around 15.33 per cent of India's oil refining capacity and 22 per cent of the fuel marketing share.

Qualified bidders can change and bring new partners before placing a financial bid, according to the terms of sale.

Disinvestment target

The government has set a

disinvestment target of Rs 65,000 crore for the financial year ending March 2023, as against its

goal of Rs 78,000 crore for the year ended March 2022. Besides BPCL, it has Rashtriya Ispat Nigam and Pawan Hans in its disinvestment pipeline and has already cleared the sale of Neelachal Ispat Nigam (NIN) to Tata Steel Long Products.

The much-awaited mega initial share sale of Life Insurance Corporation (LIC), wherein it plans to offload a five percent stake in the state-run insurance behemoth, will also help the exchequer move towards its ambitious goal.

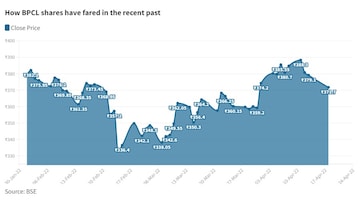

BPCL shares have seen wild swings in the past few months, with the stock moving within a range of Rs 331-397 apiece.

Here's a timeline of key events in the BPCL's ongoing disinvestment journey:

Nov 2019: Cabinet gives nod to BPCL stake sale as part of a mega disinvestment plan including SCI, Concor; it expects to complete the sale by Sept

2020: Pandemic, crash in global oil prices strains finances of global oil cos

July 2020: Government extends the deadline for submission of bids for the stake sale to September 30

Mar 2021: Shareholders give nod to disinvestment of unit Numaligarh Refinery for Rs 9,878 crore, co to sell 61.65 percent in NRL to a consortium of Oil India, Engineers India

April 2021: BPCL opens a virtual data room including financial information; access is given to qualified bidders signing a confidentiality undertaking

July 2021: Cabinet approves plans to allow 100 percent FDI in state-run oil companies in which a strategic stake sale is announced

Jan 2022: Government says BPCL privatisation likely in the year ending March 2023, the process stalled due to multiple reasons including a global push towards green energy

Feb 2022: Government brings down 2021-22 disinvestment target to Rs 78,000 crore from Rs 1.75 lakh crore citing COVID disruptions; it says divestment strategy changed, BPCL divestment likely to be completed in year ending March 2023(Edited by : Akanksha Upadhyay)

First Published: Apr 19, 2022 12:08 PM IST