In an interview with CNBC-TV18, Steven Englander, Global Head of G10 FX Research & North America Macro Strategy at Standard Chartered Bank, extensively discussed the trajectory of US yields. Pranjul Bhandari, the Chief India Economist at HSBC, also shared insights into how global developments could influence the RBI's policy decisions and its stance on liquidity and interest rates.

The Reserve Bank of India's (RBI) six-member Monetary Policy Committee (MPC) began deliberations on rates today, against the backdrop of a challenging global scenario.

This week,

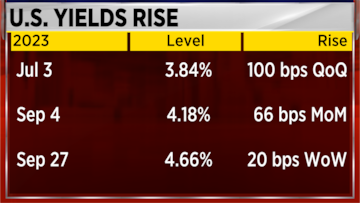

US 10-year yields have surged by 20 basis points, reaching a 16-year peak of 4.84%. Notably, US yields currently stand nearly one percentage point higher than they were when the RBI last convened in August.

Englander said, “If it becomes clear that the US is slowing down; it doesn’t have to fall off the cliff, it could just be a gentle slowdown then selected high-yielding

emerging markets will look very attractive, but in the current world especially if you are afraid if US yields are going to continue to go higher, it’s tough to be excited about anything but the dollar.”

Bhandari said the

RBI is likely to be highly cautious regarding risks at this juncture. However, she doesn't anticipate a shift in the central bank's overall position.

The RBI, she believes, may aim to adopt a more cautious stance, but it's unlikely there will be alterations in its inflation projections. Nevertheless, she emphasized that keeping an eye on inflation forecasts and liquidity measures will be important factors to watch in the forthcoming RBI policy. Any adjustments to the RBI's forecasts for both inflation and economic growth are not expected.

“At this point, the RBI will be most risk averse, and will not want to take any challenges or make any new change. So, in terms of what they do on Friday, October 6, my sense is no change in stance, no change in rates. They keep talking about the 4% target to double down on their inflation objectives and make sure people are aware of that that they want to go all the way to 4%,” she said.

While talking about growth, Bhandari said, “Things are very good in urban India as of now and that is what is keeping growth strong right now. Of course, with oil prices rising, some of that could get blunted going forward, but so far growth is extremely strong.”

For the entire discussion, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Oct 4, 2023 4:53 PM IST